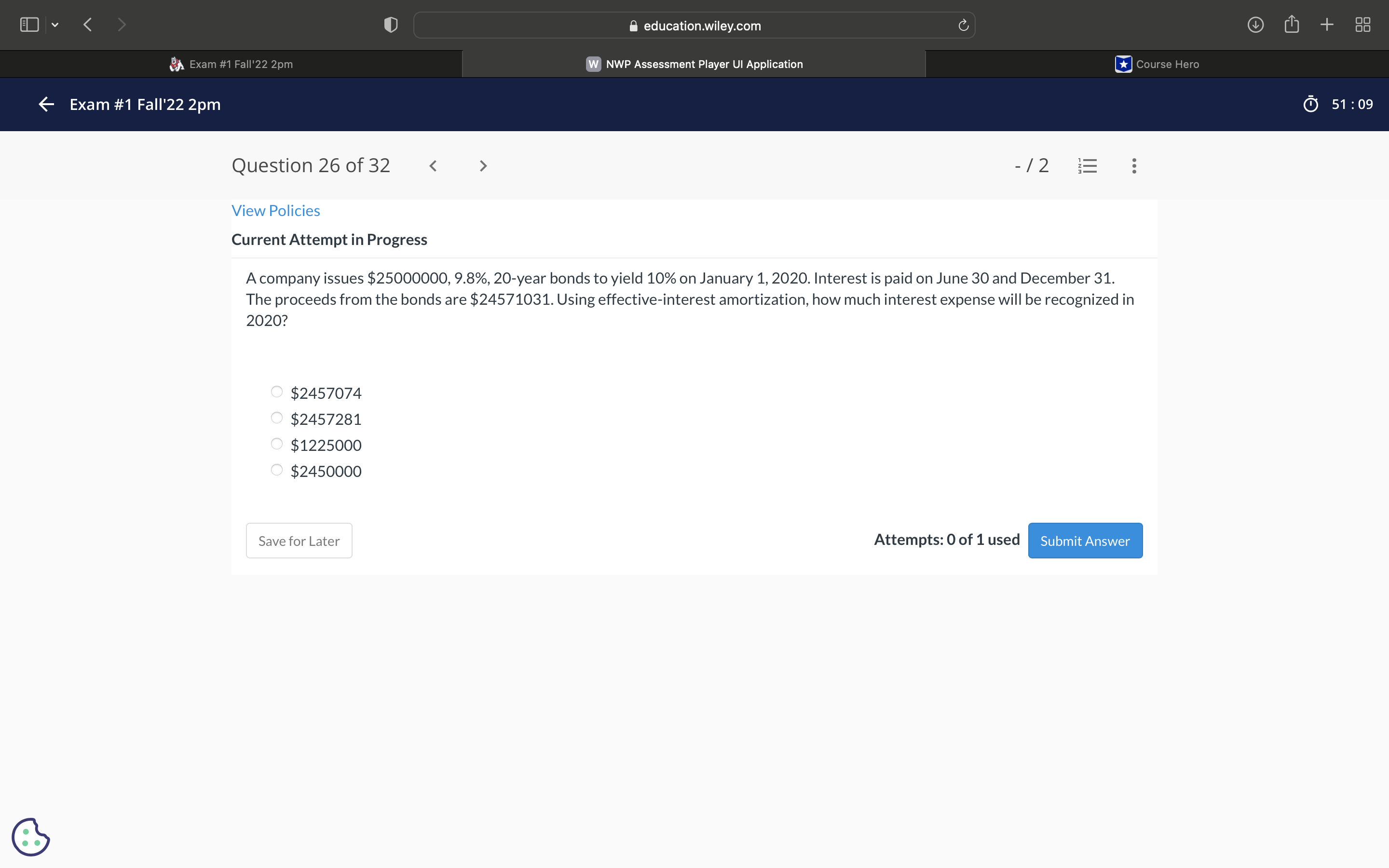

Question: v -12 3 ... View Policies Current Attempt in Progress A company issues $25000000, 9.8%, 20-year bonds to yield 10% on January 1, 2020. Interest

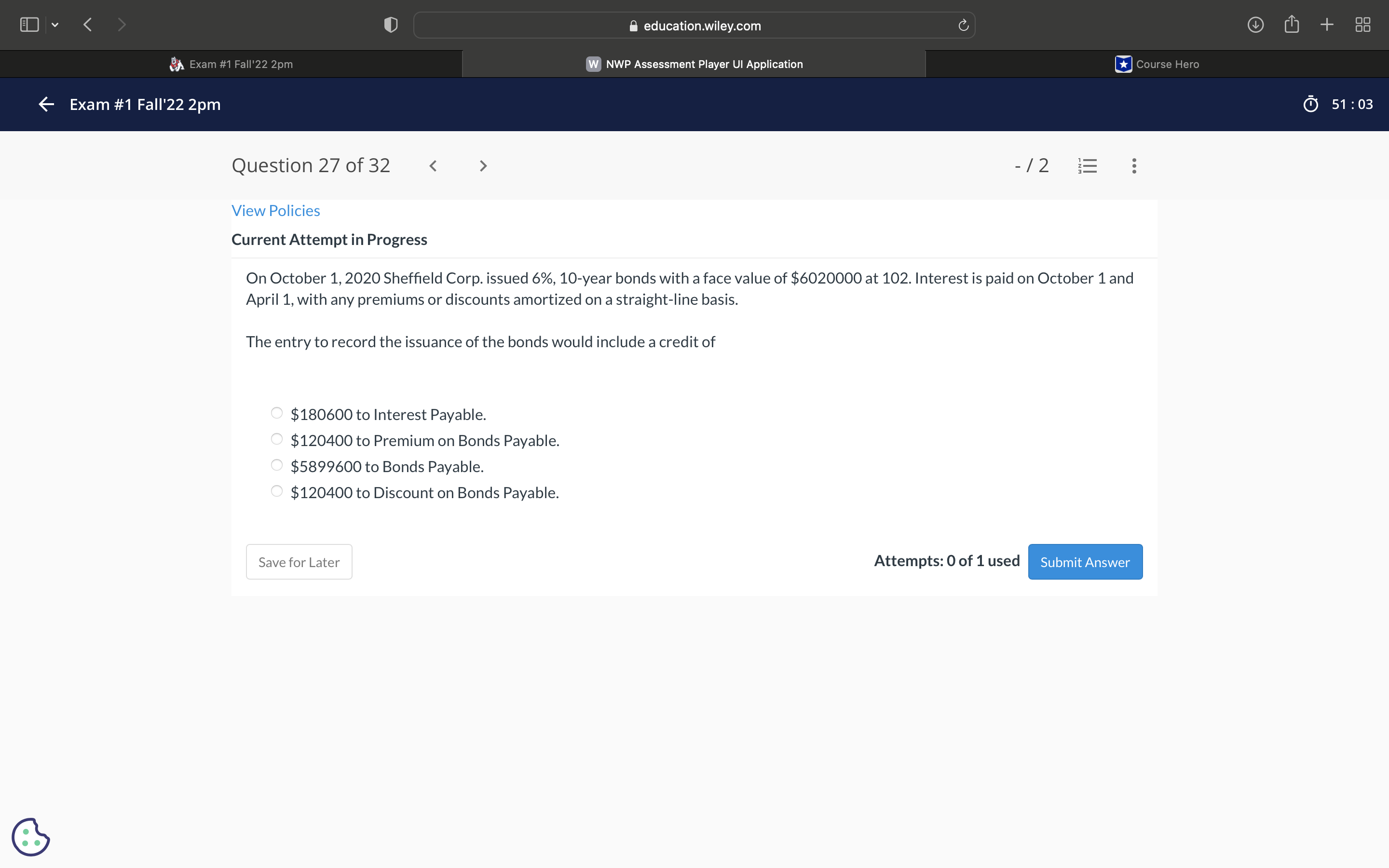

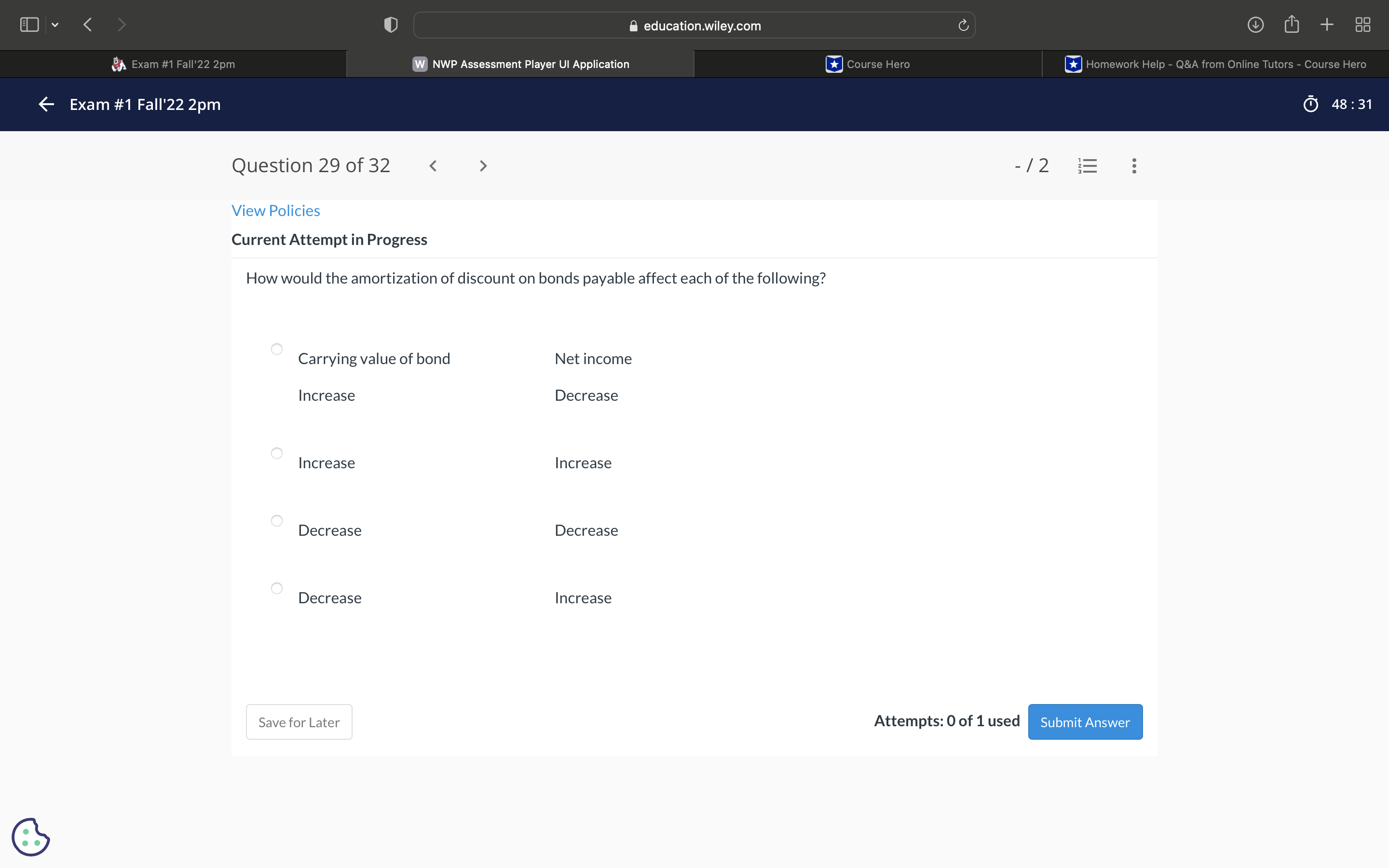

v -12 3 ... View Policies Current Attempt in Progress A company issues $25000000, 9.8%, 20-year bonds to yield 10% on January 1, 2020. Interest is paid on June 30 and December 31. The proceeds from the bonds are $24571031. Using effective-interest amortization, how much interest expense will be recognized in 2020? O $2457074 O $2457281 O $1225000 O $2450000 Save for Later Attempts: 0 of 1 used Submit Answerv ... View Policies Current Attempt in Progress On October 1, 2020 Sheffield Corp. issued 6%, 10-year bonds with a face value of $6020000 at 102. Interest is paid on October 1 and April 1, with any premiums or discounts amortized on a straight-line basis. The entry to record the issuance of the bonds would include a credit of $180600 to Interest Payable. $120400 to Premium on Bonds Payable. O $5899600 to Bonds Payable. $120400 to Discount on Bonds Payable. Save for Later Attempts: 0 of 1 used Submit Answer educationwileycom w pr Assessment Player un Application 6 Exam #1 FaII'ZZ 2pm Question 29 of 32 _ / 2 I: View Policies Current Attempt in Progress How would the amortization of discount on bonds payable affect each of the following? Carrying value of bond Net income Increase Decrease Increase Increase Decrease Decrease Decrease Increase Save for Later Attempts: 0 of 1 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts