Question: v 125% View Zoom Insert Add Category Exercise 2 Table Cha + Questions Exercise 1 Exercise 3 Exercise 4 B. D E F G H

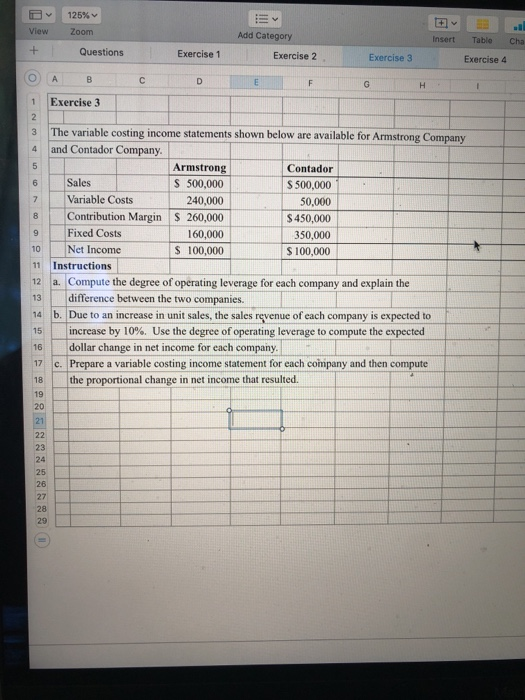

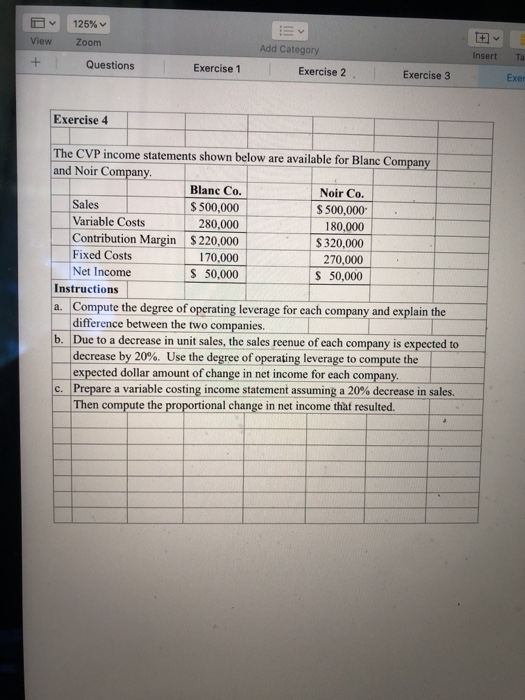

v 125% View Zoom Insert Add Category Exercise 2 Table Cha + Questions Exercise 1 Exercise 3 Exercise 4 B. D E F G H 1 Exercise 3 2 3 4 5 6 7 9 10 + The variable costing income statements shown below are available for Armstrong Company and Contador Company. Armstrong Contador Sales S 500,000 S 500,000 Variable Costs 240,000 50,000 Contribution Margin $ 260,000 $ 450,000 Fixed Costs 160,000 350,000 Net Income $ 100,000 $ 100,000 11 Instructions 12 a. Compute the degree of operating leverage for each company and explain the 13 difference between the two companies. 14 b. Due to an increase in unit sales, the sales revenue of each company is expected to 15 increase by 10%. Use the degree of operating leverage to compute the expected dollar change in net income for each company. c. Prepare a variable costing income statement for each company and then compute the proportional change in net income that resulted. 16 17 - 18 19 20 21 22 23 24 25 26 27 28 29 Tv 125% EY View Zoom Add Category + Insert Questions Exercise 1 Exercise 2 Exercise 3 Exer Exercise 4 The CVP income statements shown below are available for Blanc Company and Noir Company Blanc Co. Noir Co. Sales $ 500,000 $ 500,000 Variable Costs 280,000 180,000 Contribution Margin $ 220,000 $ 320,000 Fixed Costs 170,000 270,000 Net Income $ 50,000 $ 50,000 Instructions a. Compute the degree of operating leverage for each company and explain the difference between the two companies. b. Due to a decrease in unit sales, the sales reenue of each company is expected to decrease by 20%. Use the degree of operating leverage to compute the expected dollar amount of change in net income for each company. c. Prepare a variable costing income statement assuming a 20% decrease in sales. Then compute the proportional change in net income that resulted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts