Question: v 14 e Wrap ' ' V Times New Roman v Lo ===== Merge & Center A Paste BIU 27 X fx D Problem 9-29

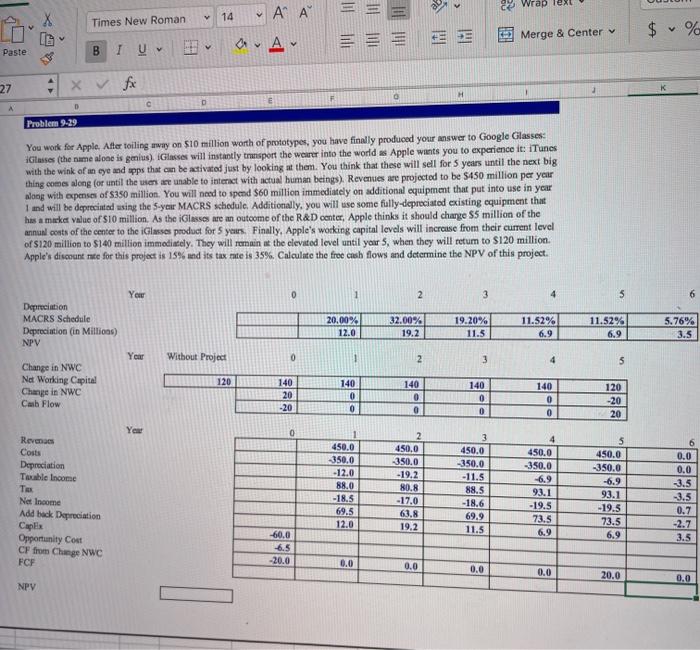

v 14 e Wrap ' ' V Times New Roman v Lo ===== Merge & Center A Paste BIU 27 X fx D Problem 9-29 You work for Apple. After toiling way on $10 million worth of prototypes, you have finally produced your answer to Google Glasses: Glasses (the name alone is genius). Glasses will instantly transport the wearer into the worlds Apple wants you to experience it: iTunes with the wink of an eye and apps that can be activated just by looking at them. You think that these will sell for 5 years until the next big thing comes along (or until the ene unable to interact with actual human beings). Revenues are projected to be $450 million per year along with expenses of $350 million. You will need to spend $60 million immediately on additional equipment that put into use in year 1 and will be depreciated using the 5-year MACRS schedule. Additionally, you will use some fully-depreciated existing equipment that has a market value of S10 million. As the Glasses are an outcome of the R&D center, Apple thinks it should charge 55 million of the annual costs of the center to the Glasses product for 5 years. Finally, Apple's working capital levels will increase from their current level of S120 million to $140 million immodiately. They will remain at the clevated level until your 5, when they will return to S120 million. Apple's discount rate for this project is 15% and its tax rate is 35% Calculate the free cash flows and determine the NPV of this project. Yom 1 2 3 4 3 Depreciation MACRS Schedule Depreciation (in Millions) NPV 11.52% 20.00% 12.0 32.00% 19.2 19.20% 11.5 11.52% 6.9 5.76% 3.5 6.9 Year Without Project 0 1 2 3 4 5 120 Change in NWC Na Working Capital Change in NWC Cab Flow 140 20 -20 140 0 0 140 0 0 140 0 140 0 0 120 -20 20 0 Year 0 Revens Costs Depreciation Touble Income Tex Net Income Add back Depreciation Capex Opportunity Cout CF from Change NWC FCF 450.0 -350.0 -12.0 88.0 -18.5 69.5 12.0 2 450,0 -350.0 -19.2 80.8 -17.0 63.8 19.2 3 450.0 -350.0 -11.5 88.5 -18.6 69.9 11.5 450.0 -350.0 -6.9 93.1 -19.5 73.5 6.9 5 450.0 -350.0 -6.9 93.1 -19.5 73.5 6.9 0.0 0.0 -3.5 -3.5 0.7 -2.7 3.5 -60.0 -6.5 -20.0 0.0 0.0 0.0 0.0 20.0 0.0 NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts