Question: v 2 . cengagenow.com er mon com... TEST # 2 ( Chps 5 - 8 ) CengageNOWv 2 | Online... Which of the following taxpayers

vcengagenow.com

er mon com...

TEST #Chps

CengageNOWv Online...

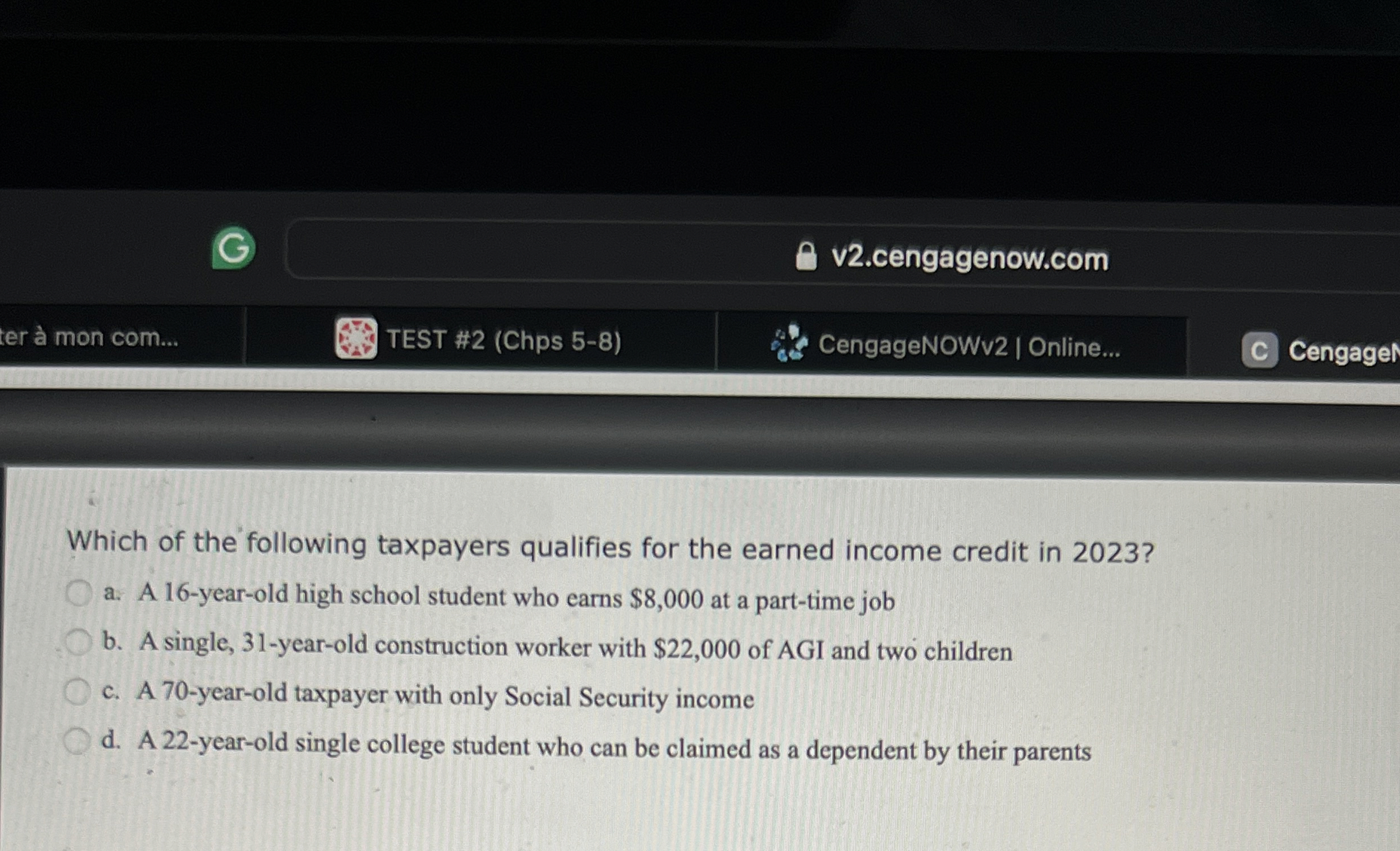

Which of the following taxpayers qualifies for the earned income credit in

a A yearold high school student who earns $ at a parttime job

b A single, yearold construction worker with $ of AGI and two children

c A yearold taxpayer with only Social Security income

d A yearold single college student who can be claimed as a dependent by their parents

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock