Question: V . Assessing risk 3 8 . Has detection risk been appropriately restricted to determine how much inherent risk can be accepted? 3 9 .

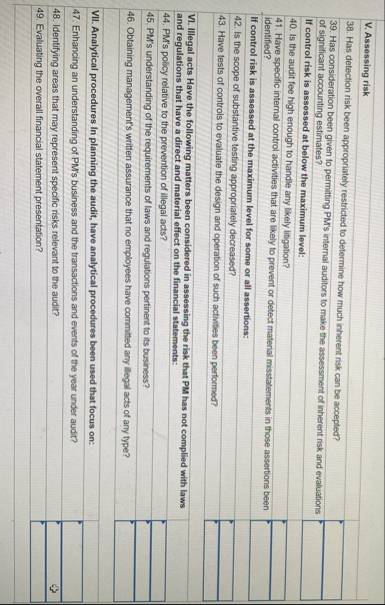

V Assessing risk

Has detection risk been appropriately restricted to determine how much inherent risk can be accepted?

Has consideration been given to permitting PMs internal auditors to make the assessment of inherent risk and evaluations of significant accounting estimates?

If control risk is assessed at below the maximum level:

Is the audit fee high enough to handle any likely litigation?

Have specific internal control activities that are likely to prevent or detect material misstatements in those assertions been identified?

If control risk is assessed at the maximum level for some or all assertions:

Is the scope of substantive testing appropriately decreased?

Have tests of controls to evaluate the design and operation of such activities been performed?

VI Hegal acts Have the following matters been considered in assessing the risk that PM has not complied with laws and regulations that have a direct and material effect on the financial statements:

PMs policy relative to the prevention of illegal acts?

PMs understanding of the requirements of laws and regulations pertinent to its business?

Obtaining management's written assurance that no employees have committed any illegal acts of any type?

VII. Analytical procedures In planning the audit, have analytical procedures been used that focus on:

Enhancing an understanding of PMs business and the transactions and events of the year under audit?

Identifying areas that may represent specific risks relevant to the audit?

Evaluating the overall financial statement presentation?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock