Question: V. Binomial trees Consider the 3-step recombining (d = 1/u) spot price tree 7 months from expiration and current value of the underlying at 35.00

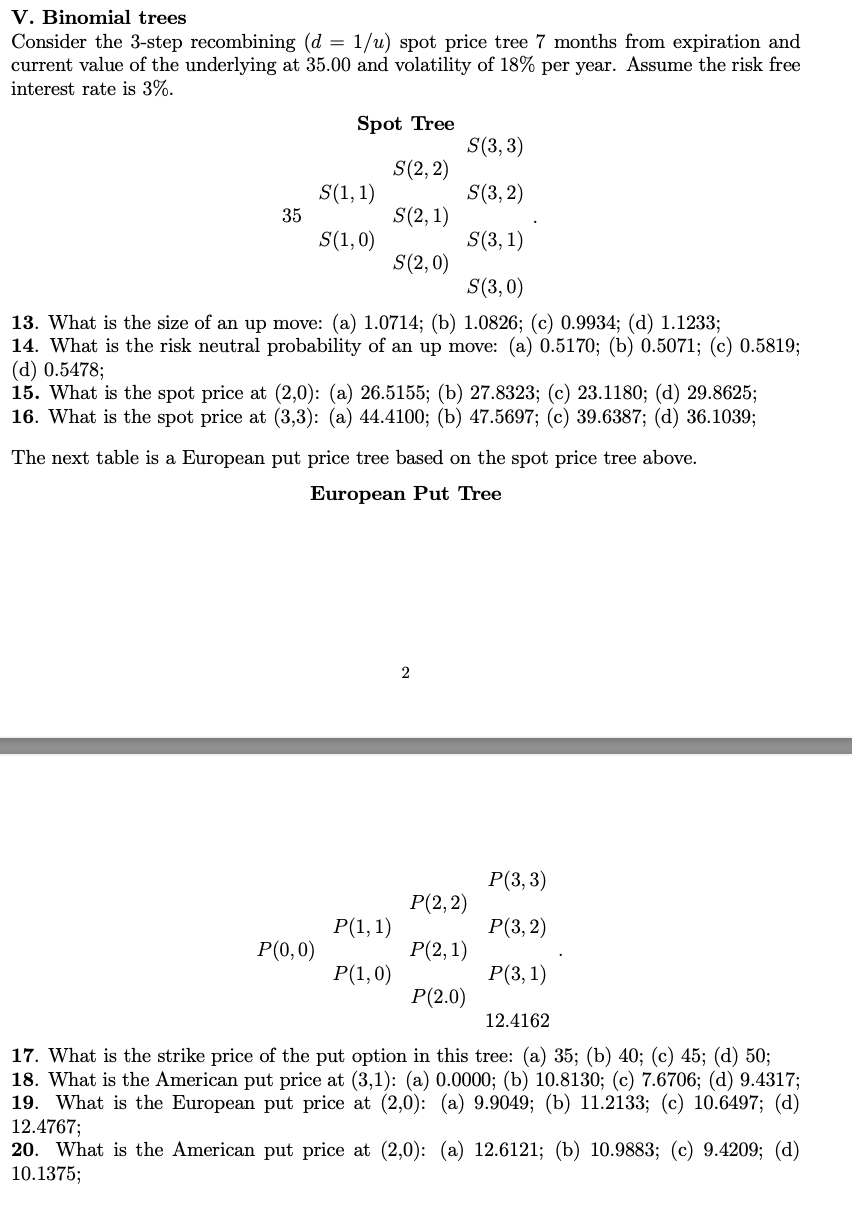

V. Binomial trees Consider the 3-step recombining (d = 1/u) spot price tree 7 months from expiration and current value of the underlying at 35.00 and volatility of 18% per year. Assume the risk free interest rate is 3%. Spot Tree S(3, 3) S(2, 2) S(1,1) S(3,2) 35 S(2, 1) S(1,0) S(3,1) S(2,0) S(3,0) 13. What is the size of an up move: (a) 1.0714; (b) 1.0826; (C) 0.9934; (d) 1.1233; 14. What is the risk neutral probability of an up move: (a) 0.5170; (b) 0.5071; (c) 0.5819; (d) 0.5478; 15. What is the spot price at (2,0): (a) 26.5155; (b) 27.8323; (c) 23.1180; (d) 29.8625; 16. What is the spot price at (3,3): (a) 44.4100; (b) 47.5697; (c) 39.6387; (d) 36.1039; The next table is a European put price tree based on the spot price tree above. European Put Tree 2 P(3,3) P(2,2) P(1,1) P(3,2) P(0,0) P(2,1) P(1,0) P(3,1) P(2.0) 12.4162 17. What is the strike price of the put option in this tree: (a) 35; (b) 40; (c) 45; (d) 50; 18. What is the American put price at (3,1): (a) 0.0000; (b) 10.8130; (c) 7.6706; (d) 9.4317; 19. What is the European put price at (2,0): (a) 9.9049; (b) 11.2133; (c) 10.6497; (d) 12.4767; 20. What is the American put price at (2,0): (a) 12.6121; (b) 10.9883; (c) 9.4209; (d) 10.1375; V. Binomial trees Consider the 3-step recombining (d = 1/u) spot price tree 7 months from expiration and current value of the underlying at 35.00 and volatility of 18% per year. Assume the risk free interest rate is 3%. Spot Tree S(3, 3) S(2, 2) S(1,1) S(3,2) 35 S(2, 1) S(1,0) S(3,1) S(2,0) S(3,0) 13. What is the size of an up move: (a) 1.0714; (b) 1.0826; (C) 0.9934; (d) 1.1233; 14. What is the risk neutral probability of an up move: (a) 0.5170; (b) 0.5071; (c) 0.5819; (d) 0.5478; 15. What is the spot price at (2,0): (a) 26.5155; (b) 27.8323; (c) 23.1180; (d) 29.8625; 16. What is the spot price at (3,3): (a) 44.4100; (b) 47.5697; (c) 39.6387; (d) 36.1039; The next table is a European put price tree based on the spot price tree above. European Put Tree 2 P(3,3) P(2,2) P(1,1) P(3,2) P(0,0) P(2,1) P(1,0) P(3,1) P(2.0) 12.4162 17. What is the strike price of the put option in this tree: (a) 35; (b) 40; (c) 45; (d) 50; 18. What is the American put price at (3,1): (a) 0.0000; (b) 10.8130; (c) 7.6706; (d) 9.4317; 19. What is the European put price at (2,0): (a) 9.9049; (b) 11.2133; (c) 10.6497; (d) 12.4767; 20. What is the American put price at (2,0): (a) 12.6121; (b) 10.9883; (c) 9.4209; (d) 10.1375

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts