Question: V . Bt So= to B. (23 points) Consider a 2-period problem with 2 = {W1, ... , ws), r = 0, Bo = 1.0,

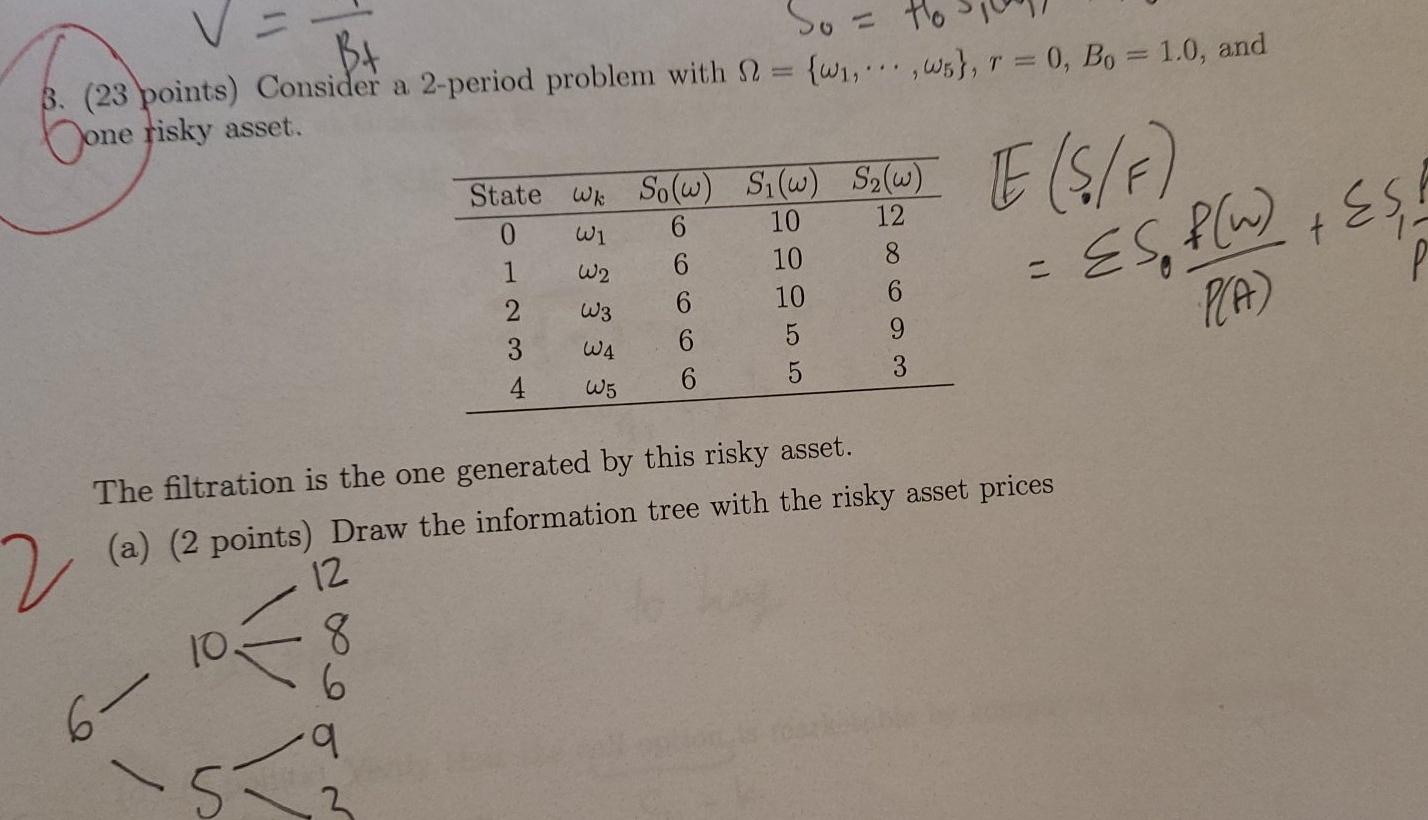

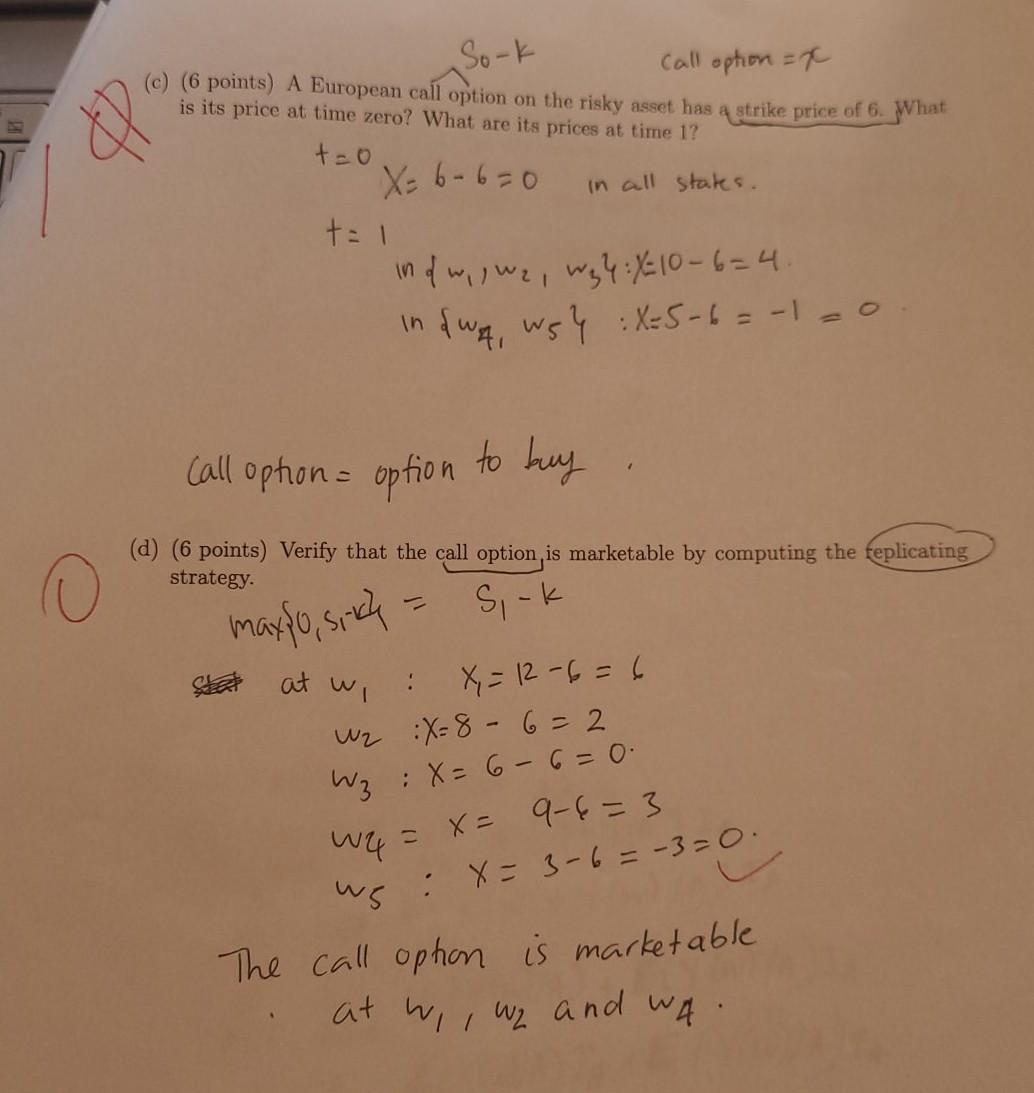

V . Bt So= to B. (23 points) Consider a 2-period problem with 2 = {W1, ... , ws), r = 0, Bo = 1.0, and one risky asset. E (5/7) State Wk Sow) Si(w) S2(w) 0 6 W1 12 10 1 6 10 8 2 6 W3 6 10 3 6 5 4 3 6 W5 5 W2 Esh ESP(w) + NA) 2 The filtration is the one generated by this risky asset. (a) (2 points) Draw the information tree with the risky asset prices 12 8 6 a 10 6 53 Sork call option = x (c) (6 points) A European call option on the risky asset has a strike price of 6. What is its price at time zero? What are its prices at time 1? t=o X= 6-6=0 in all stakes. t=1 infwi, wz, wgl :X=10 - 6=4. in fwa, wsy :X-5-6=-1 = 0 Call option = option to buy (d) (6 points) Verify that the call option is marketable by computing the replicating strategy Sirk maxso, sikh te at wi : X = 12-6 = 6 W2 X=8-6=2 X=6 - 6= 0. x = 9-6=3 Wz wy 0. ws : x= 3-6=-3=0 The call option is marketable at ww2 and wa. V . Bt So= to B. (23 points) Consider a 2-period problem with 2 = {W1, ... , ws), r = 0, Bo = 1.0, and one risky asset. E (5/7) State Wk Sow) Si(w) S2(w) 0 6 W1 12 10 1 6 10 8 2 6 W3 6 10 3 6 5 4 3 6 W5 5 W2 Esh ESP(w) + NA) 2 The filtration is the one generated by this risky asset. (a) (2 points) Draw the information tree with the risky asset prices 12 8 6 a 10 6 53 Sork call option = x (c) (6 points) A European call option on the risky asset has a strike price of 6. What is its price at time zero? What are its prices at time 1? t=o X= 6-6=0 in all stakes. t=1 infwi, wz, wgl :X=10 - 6=4. in fwa, wsy :X-5-6=-1 = 0 Call option = option to buy (d) (6 points) Verify that the call option is marketable by computing the replicating strategy Sirk maxso, sikh te at wi : X = 12-6 = 6 W2 X=8-6=2 X=6 - 6= 0. x = 9-6=3 Wz wy 0. ws : x= 3-6=-3=0 The call option is marketable at ww2 and wa

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts