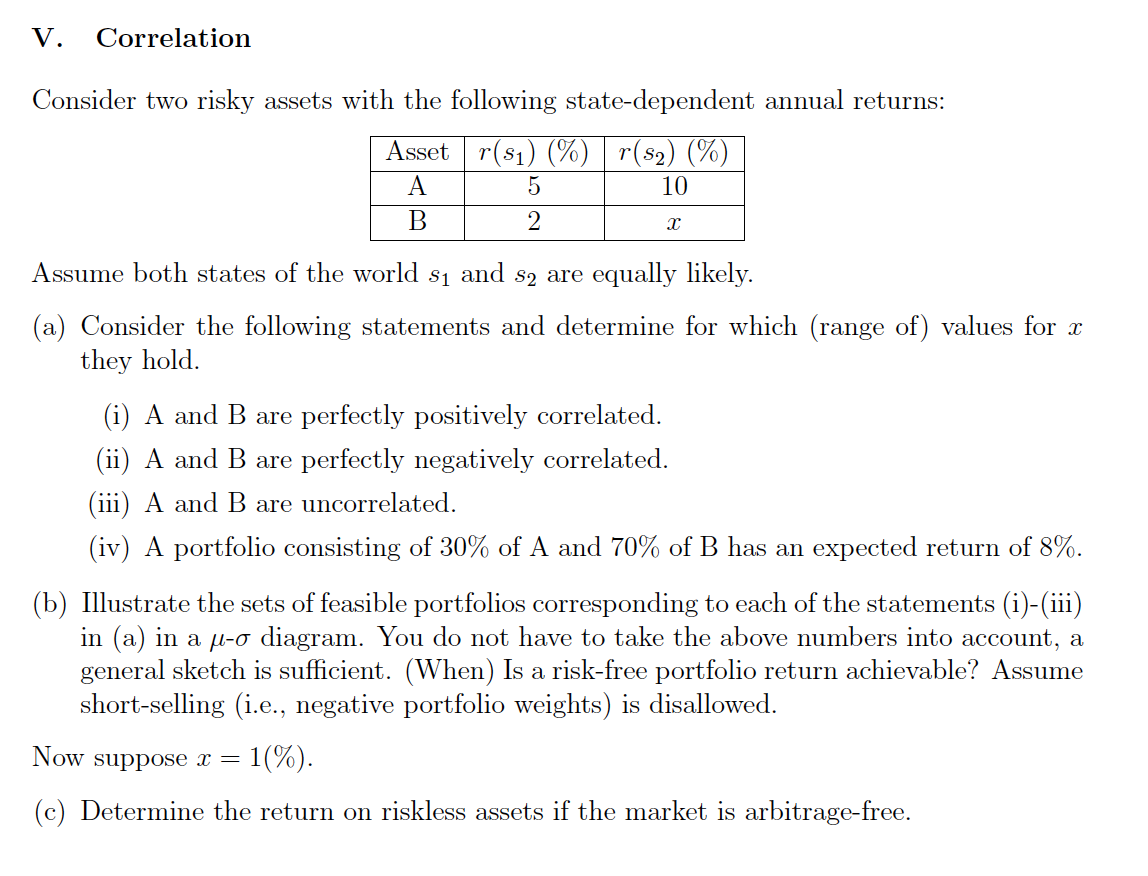

Question: V. Correlation Consider two risky assets with the following state-dependent annual returns: Asset r(S1) (%) r(82) (%) A 10 B 2 Assume both states of

V. Correlation Consider two risky assets with the following state-dependent annual returns: Asset r(S1) (%) r(82) (%) A 10 B 2 Assume both states of the world s and s2 are equally likely. (a) Consider the following statements and determine for which (range of) values for x they hold. (i) A and B are perfectly positively correlated. (ii) A and B are perfectly negatively correlated. (iii) A and B are uncorrelated. (iv) A portfolio consisting of 30% of A and 70% of B has an expected return of 8%. (b) Illustrate the sets of feasible portfolios corresponding to each of the statements (i)-(iii) in (a) in a 4-o diagram. You do not have to take the above numbers into account, a general sketch is sufficient. (When) Is a risk-free portfolio return achievable? Assume short-selling (i.e., negative portfolio weights) is disallowed. Now suppose x = 1(%). (c) Determine the return on riskless assets if the market is arbitrage-free

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts