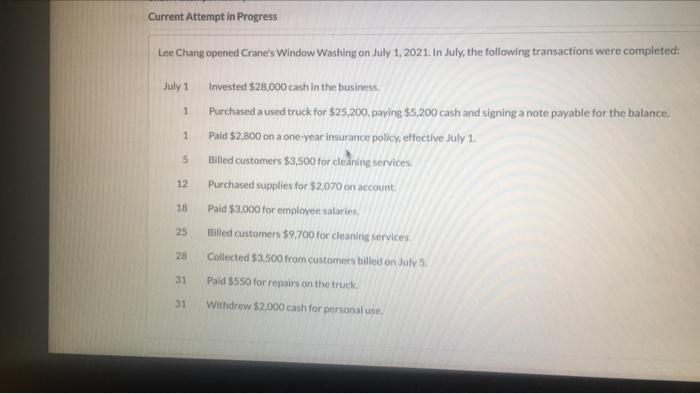

Question: v Current Attempt in Progress Lee Chang opened Crane's Window Washing on July 1, 2021. In July, the following transactions were completed: July 1 1

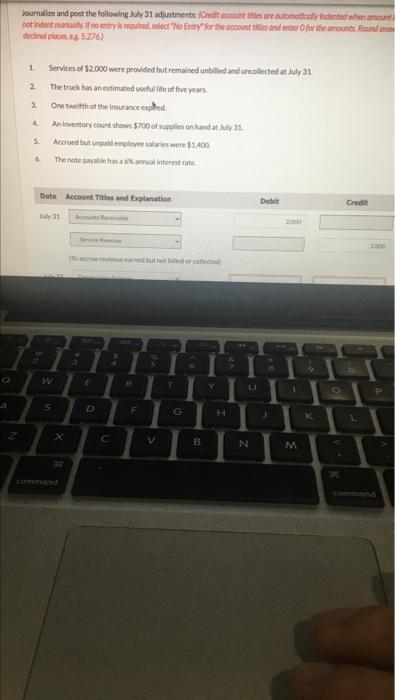

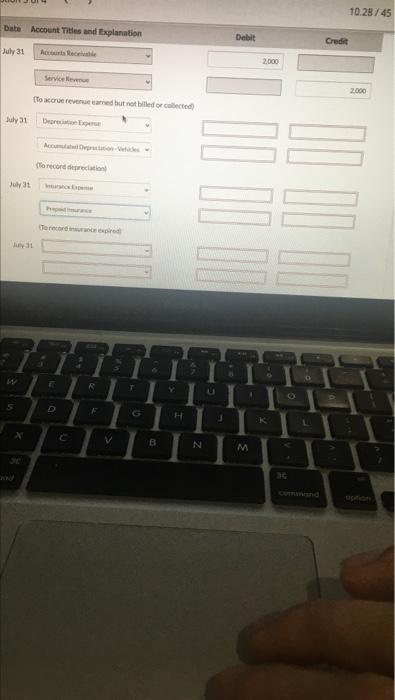

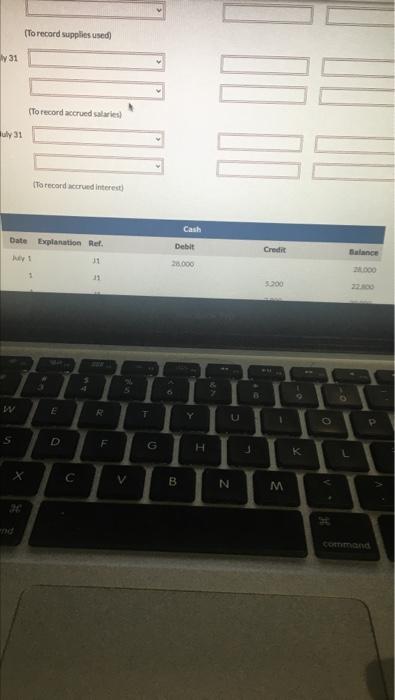

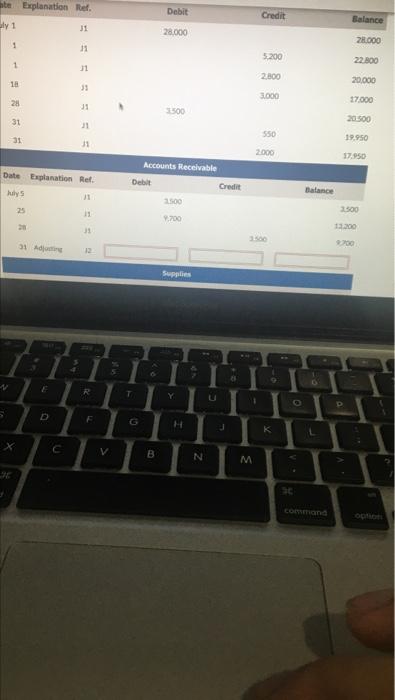

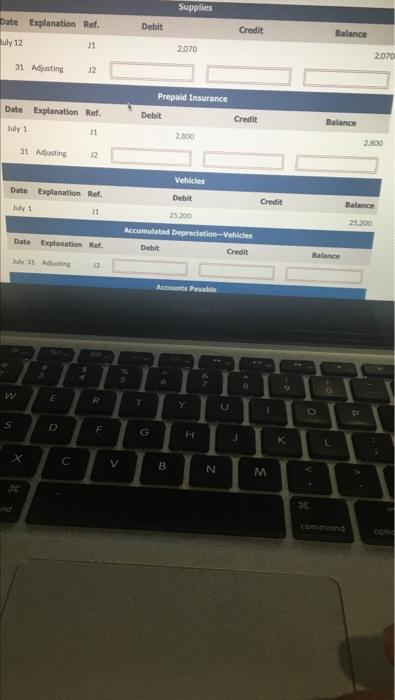

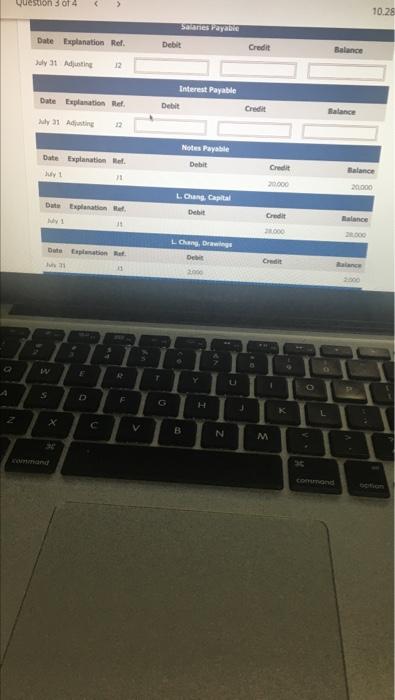

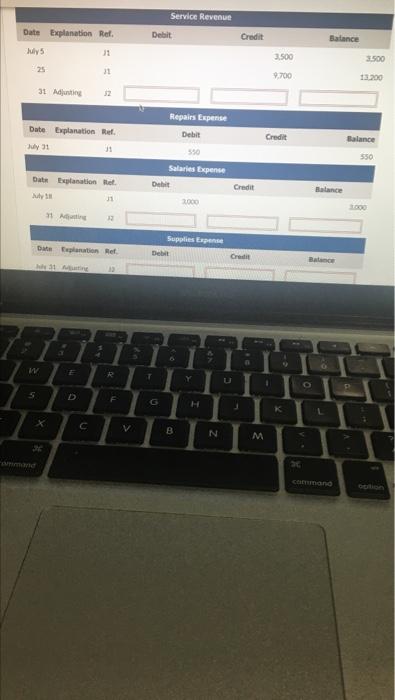

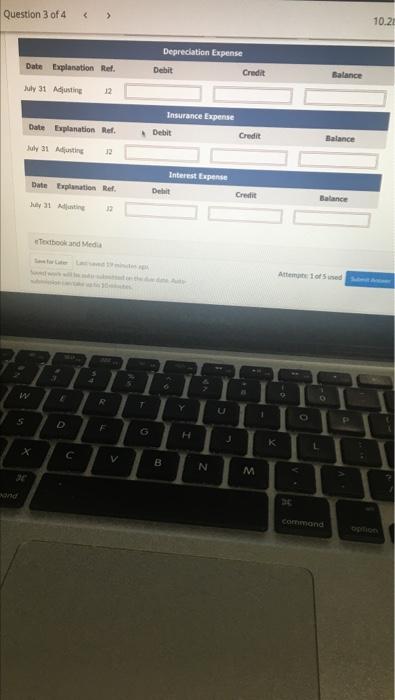

Current Attempt in Progress Lee Chang opened Crane's Window Washing on July 1, 2021. In July, the following transactions were completed: July 1 1 1 5 12 Invested $28,000 cash in the business, Purchased a used truck for $25.200, paying $5,200 cash and signing a note payable for the balance. Paid $2,800 on a one-year insurance policy, effective July 1. Billed customers $3,500 for cleaning services. Purchased supplies for $2,070 on account Pald $3,000 for employee salaries Billed customers $9.700 for cleaning services Collected $3.500 from customers billed on July 5. Pald $550 for repairs on the truck 18 25 28 31 31 Withdrew $2,000 cash for personal use. Journalise and post the following July 31 adjustments. Omdaccount titles are submitteally inderted when more not inden manuelle I no entry kit repulred, street Nord for the accountilles and enter for the amounts. Round am decimal places 5.276) 1 2 3 Services of $2.000 were provided but remained unbilled and uncollected at July 31. The truck has an estimated use life of five years One twelfth of the insurance expiled. Anitventory count shows $700 of supplies on hand at July 31. Accrued but unpaid loyee salaries were $1.400 The note pale ha annual interest rate 4. 5. 6 Date Account Tities and Explanation Debit Credit Tout other 737 w T Y U S D F G Z V B N M COVENTRO 10.28/45 Date Account Titles and Explanation Debit Credit July 31 Antece 2.000 Service 2.000 Torreve came to bited or collected My 31 Draw to record declin o T Y u 1 5 D G K X V B N M (To record supplies used) y31 II III To record accrued as uly 31 To record core interest) Date Explanation et Cash Debit Credit 26.000 2000 11 200 E T Y 1 o P S D G H K L L V B N M Comend te Explanation Ref. Debit Credit Balance Bly 1 31 28.000 28.000 1 11 5.200 1 22.800 11 2.800 18 20,000 33 3.000 17.000 28 1500 31 20500 550 31 12.950 1 2.000 17.950 Accounts Receivable Date Explanation Rel. Debit Credit Julys Balance 200 100 V.200 132300 11500 31 Adig 2200 12 Supplies E . Y 5 D G 5 J K L c B N M command Supplies Date Explanation Ref. Debit Credit Balance July 12 31 2070 2070 31 Adjusting 12 Prepaid Insurance Date Explanation Ref. July 1 Debit Credit Balance 2.800 2.800 31 Austing 12 Vehicles Date Explanation Ref. 11 Debit Credit My Balance 25.200 Accumulated Depreciation-Vehicles Debit Credit Date Explanation Balance WA 2 Accounts Payable 5 o 8 w E T Y U o S D F L C V B N M M command GO question 3 0 4 10.28 Salones Payale Date Explanation Ref. Debit Credit Balance Suly 31 Adjusting 12 Interest Payable Date Explanation et Debit Credit Balance 12 Date Explanation of Wt 11 Notes Payable Debit Credit Balance 20.000 20.000 Duteplation et L. Chang, Capital Debit Balance Credit 2000 2000 Deon Rot L Chang, Drawings De C 11 100 2000 w Y U O D F H J K L X V B N M Service Revenue Date Explanation Rel. Debit Credit Balance Julys 3.500 3.500 25 21 9.700 13.200 31 Adjusting JZ Date Explanation Ref July 01 11 Repairs Expense Debit Credit Balance 550 Date Explanation Met 550 Salaries Expense Debit 2000 Credit Balance 000 12 Supplies Expense Date nation et Beit Credit Bate 11 w .R Y S D F G H . V B N M Cand Question 3 of 4 10.21 Depreciation Expense Debit Credit Balance Date aplanation Ref. 31 Adjusting 12 Insurance Expense Date Explanation Ref. Debit Credit Balance May 31 Misting 2 Date Explanation of Interest Expense Delit Crestit Balance 31 de odbook and Media Am fosse 6 w U D F L X C V N M und Command Current Attempt in Progress Lee Chang opened Crane's Window Washing on July 1, 2021. In July, the following transactions were completed: July 1 1 1 5 12 Invested $28,000 cash in the business, Purchased a used truck for $25.200, paying $5,200 cash and signing a note payable for the balance. Paid $2,800 on a one-year insurance policy, effective July 1. Billed customers $3,500 for cleaning services. Purchased supplies for $2,070 on account Pald $3,000 for employee salaries Billed customers $9.700 for cleaning services Collected $3.500 from customers billed on July 5. Pald $550 for repairs on the truck 18 25 28 31 31 Withdrew $2,000 cash for personal use. Journalise and post the following July 31 adjustments. Omdaccount titles are submitteally inderted when more not inden manuelle I no entry kit repulred, street Nord for the accountilles and enter for the amounts. Round am decimal places 5.276) 1 2 3 Services of $2.000 were provided but remained unbilled and uncollected at July 31. The truck has an estimated use life of five years One twelfth of the insurance expiled. Anitventory count shows $700 of supplies on hand at July 31. Accrued but unpaid loyee salaries were $1.400 The note pale ha annual interest rate 4. 5. 6 Date Account Tities and Explanation Debit Credit Tout other 737 w T Y U S D F G Z V B N M COVENTRO 10.28/45 Date Account Titles and Explanation Debit Credit July 31 Antece 2.000 Service 2.000 Torreve came to bited or collected My 31 Draw to record declin o T Y u 1 5 D G K X V B N M (To record supplies used) y31 II III To record accrued as uly 31 To record core interest) Date Explanation et Cash Debit Credit 26.000 2000 11 200 E T Y 1 o P S D G H K L L V B N M Comend te Explanation Ref. Debit Credit Balance Bly 1 31 28.000 28.000 1 11 5.200 1 22.800 11 2.800 18 20,000 33 3.000 17.000 28 1500 31 20500 550 31 12.950 1 2.000 17.950 Accounts Receivable Date Explanation Rel. Debit Credit Julys Balance 200 100 V.200 132300 11500 31 Adig 2200 12 Supplies E . Y 5 D G 5 J K L c B N M command Supplies Date Explanation Ref. Debit Credit Balance July 12 31 2070 2070 31 Adjusting 12 Prepaid Insurance Date Explanation Ref. July 1 Debit Credit Balance 2.800 2.800 31 Austing 12 Vehicles Date Explanation Ref. 11 Debit Credit My Balance 25.200 Accumulated Depreciation-Vehicles Debit Credit Date Explanation Balance WA 2 Accounts Payable 5 o 8 w E T Y U o S D F L C V B N M M command GO question 3 0 4 10.28 Salones Payale Date Explanation Ref. Debit Credit Balance Suly 31 Adjusting 12 Interest Payable Date Explanation et Debit Credit Balance 12 Date Explanation of Wt 11 Notes Payable Debit Credit Balance 20.000 20.000 Duteplation et L. Chang, Capital Debit Balance Credit 2000 2000 Deon Rot L Chang, Drawings De C 11 100 2000 w Y U O D F H J K L X V B N M Service Revenue Date Explanation Rel. Debit Credit Balance Julys 3.500 3.500 25 21 9.700 13.200 31 Adjusting JZ Date Explanation Ref July 01 11 Repairs Expense Debit Credit Balance 550 Date Explanation Met 550 Salaries Expense Debit 2000 Credit Balance 000 12 Supplies Expense Date nation et Beit Credit Bate 11 w .R Y S D F G H . V B N M Cand Question 3 of 4 10.21 Depreciation Expense Debit Credit Balance Date aplanation Ref. 31 Adjusting 12 Insurance Expense Date Explanation Ref. Debit Credit Balance May 31 Misting 2 Date Explanation of Interest Expense Delit Crestit Balance 31 de odbook and Media Am fosse 6 w U D F L X C V N M und Command

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts