Question: V. Flushing Corp. produces a single product. Variable manufacturing overhead is applied to products on the basis of direct-labor hours. The standard cost card

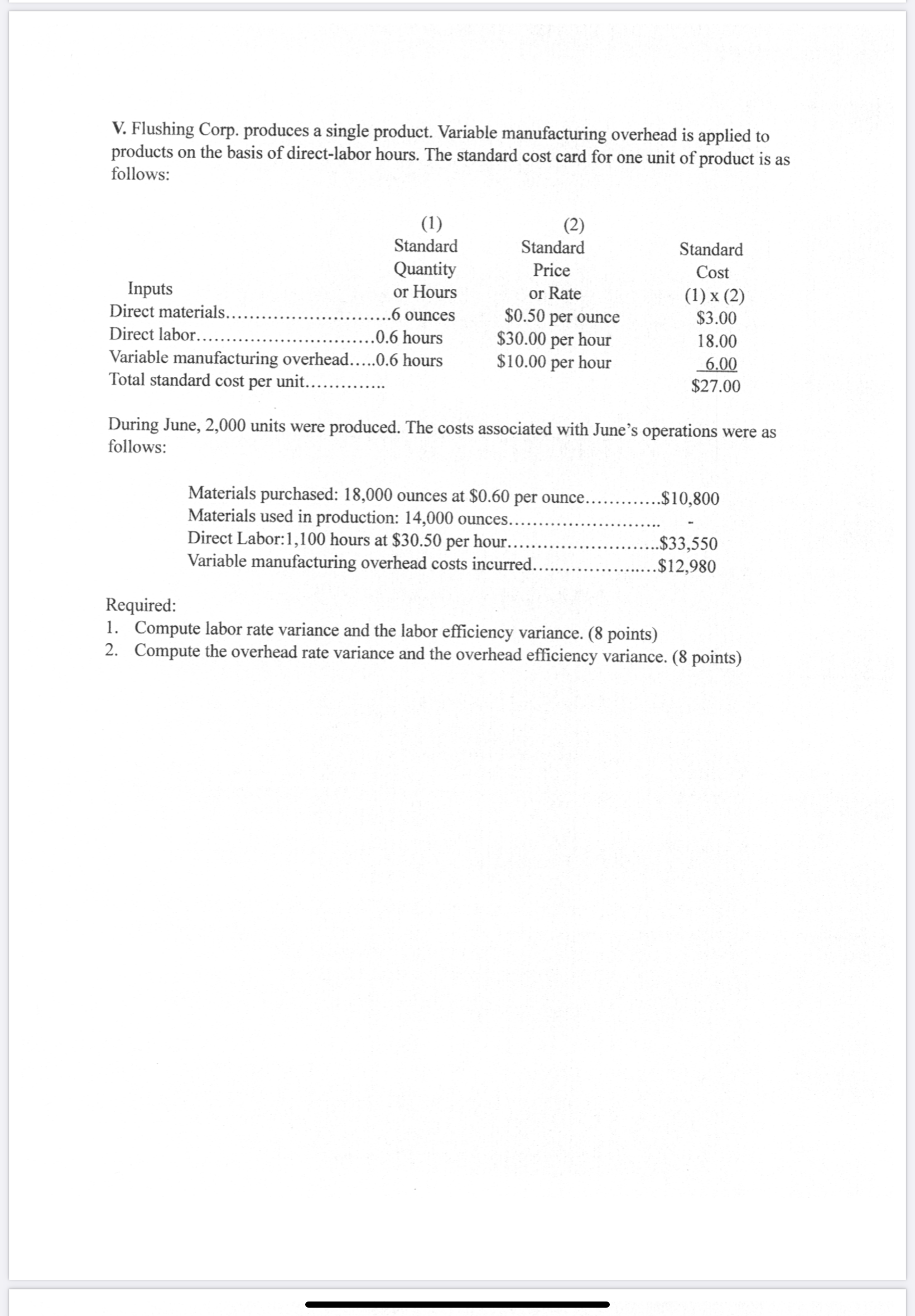

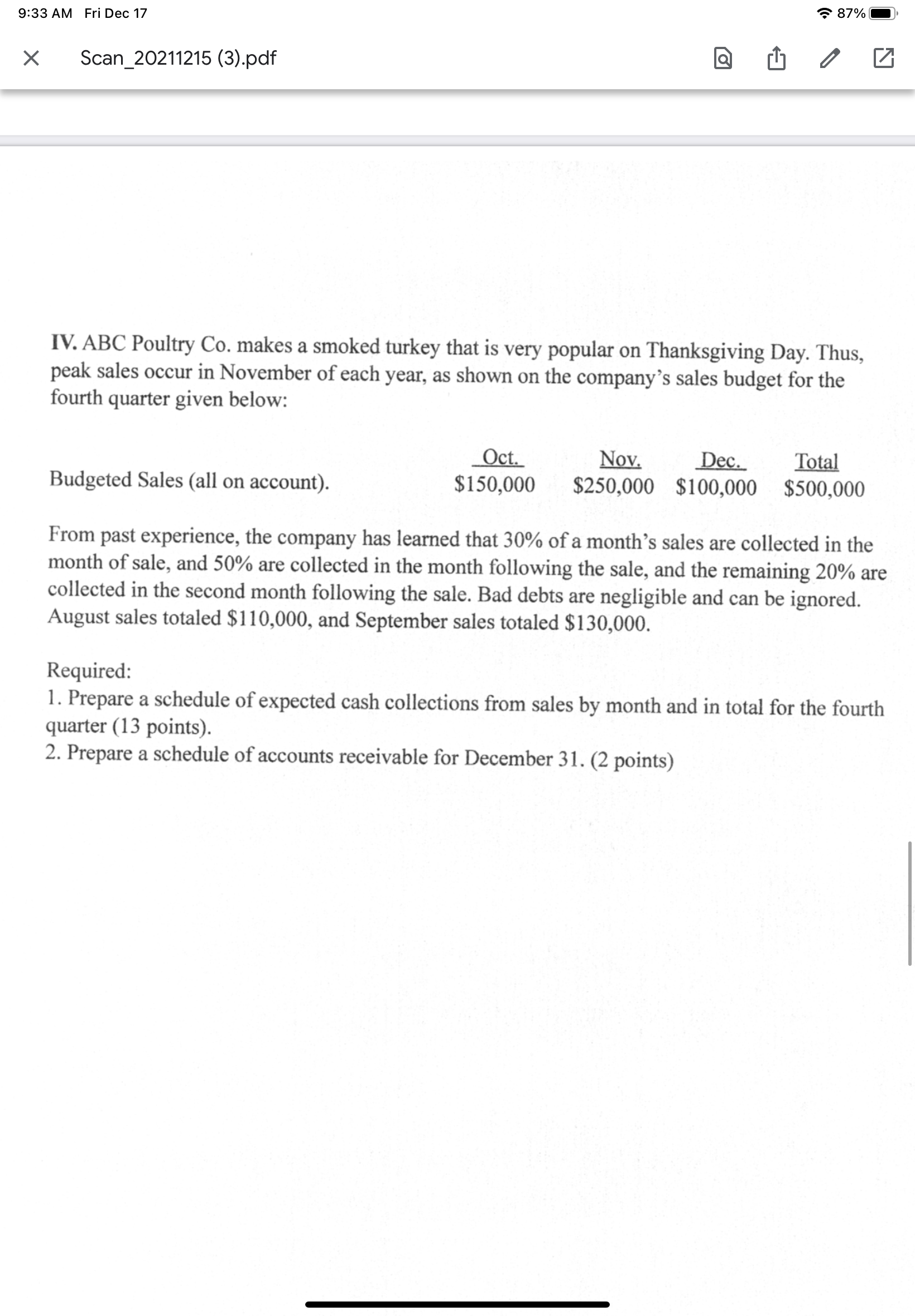

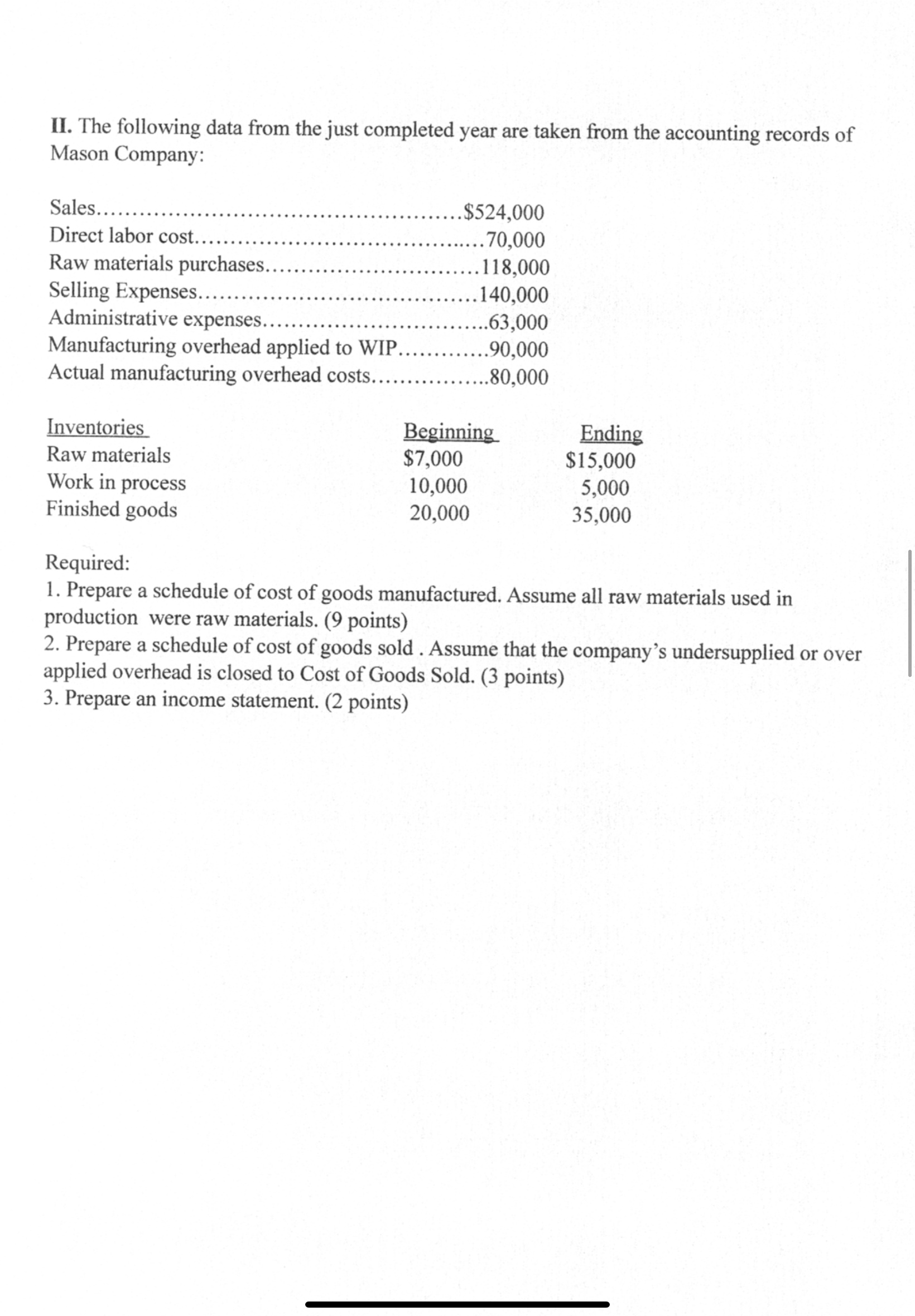

V. Flushing Corp. produces a single product. Variable manufacturing overhead is applied to products on the basis of direct-labor hours. The standard cost card for one unit of product is as follows: (1) Standard (2) Standard Standard Quantity Price Cost Inputs Direct materials.. or Hours or Rate (1) x (2) ...6 ounces $0.50 per ounce $3.00 Direct labor..... ..0.6 hours $30.00 per hour 18.00 Variable manufacturing overhead.....0.6 hours Total standard cost per unit....... $10.00 per hour 6.00 $27.00 During June, 2,000 units were produced. The costs associated with June's operations were as follows: Required: Materials purchased: 18,000 ounces at $0.60 per ounce. Materials used in production: 14,000 ounces... ..$10,800 .$33,550 .$12,980 Direct Labor:1,100 hours at $30.50 per hour... Variable manufacturing overhead costs incurred... 1. Compute labor rate variance and the labor efficiency variance. (8 points) 2. Compute the overhead rate variance and the overhead efficiency variance. (8 points) 9:33 AM Fri Dec 17 Scan_20211215 (3).pdf 87% IV. ABC Poultry Co. makes a smoked turkey that is very popular on Thanksgiving Day. Thus, peak sales occur in November of each year, as shown on the company's sales budget for the fourth quarter given below: Budgeted Sales (all on account). Oct. $150,000 Nov. Dec. $250,000 $100,000 Total $500,000 From past experience, the company has learned that 30% of a month's sales are collected in the month of sale, and 50% are collected in the month following the sale, and the remaining 20% are collected in the second month following the sale. Bad debts are negligible and can be ignored. August sales totaled $110,000, and September sales totaled $130,000. Required: 1. Prepare a schedule of expected cash collections from sales by month and in total for the fourth quarter (13 points). 2. Prepare a schedule of accounts receivable for December 31. (2 points) II. The following data from the just completed year are taken from the accounting records of Mason Company: Sales........ Direct labor cost...... .$524,000 .70,000 Raw materials purchases.. 118,000 Selling Expenses... .140,000 Administrative expenses...... ..63,000 Manufacturing overhead applied to WIP.. ..90,000 Actual manufacturing overhead costs........ .80.000 Inventories Beginning Ending Raw materials $7,000 $15,000 Work in process 10,000 5,000 Finished goods 20,000 35,000 Required: 1. Prepare a schedule of cost of goods manufactured. Assume all raw materials used in production were raw materials. (9 points) 2. Prepare a schedule of cost of goods sold. Assume that the company's undersupplied or over applied overhead is closed to Cost of Goods Sold. (3 points) 3. Prepare an income statement. (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts