Question: v Normal No Spacing Heading 1 Hea Module #2 Personal Finance Homework Use a Financial Calculator to solve these problems and round to the nearest

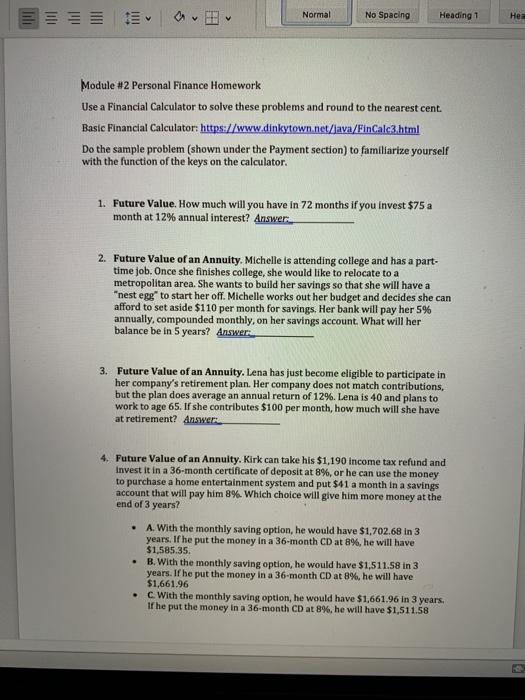

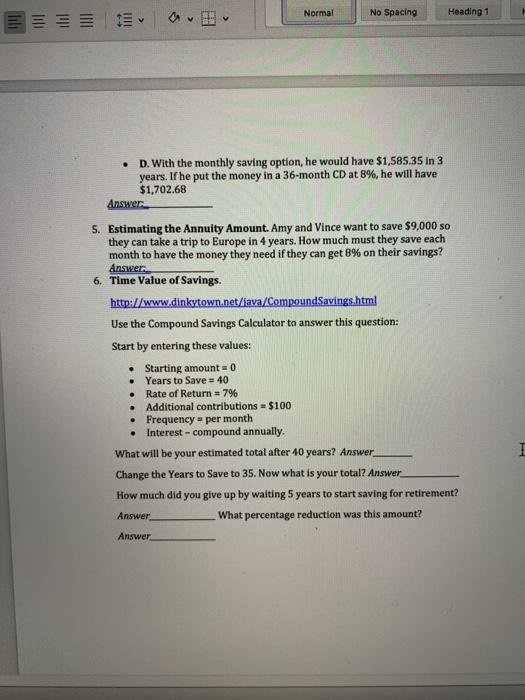

v Normal No Spacing Heading 1 Hea Module #2 Personal Finance Homework Use a Financial Calculator to solve these problems and round to the nearest cent. Basic Financial Calculator: https://www.dinkytown.net/lava/Fincalc3.html Do the sample problem (shown under the Payment section) to familiarize yourself with the function of the keys on the calculator. 1. Future Value. How much will you have in 72 months if you invest $75 a month at 12% annual interest? Answer 2. Future Value of an Annuity. Michelle is attending college and has a part- time job. Once she finishes college, she would like to relocate to a metropolitan area. She wants to build her savings so that she will have a "nest egg to start her off. Michelle works out her budget and decides she can afford to set aside $110 per month for savings. Her bank will pay her 5% annually, compounded monthly, on her savings account. What will her balance be in 5 years? Answer 3. Future Value of an Annuity. Lena has just become eligible to participate in her company's retirement plan. Her company does not match contributions, but the plan does average an annual return of 12%. Lena is 40 and plans to work to age 65. If she contributes $100 per month, how much will she have at retirement? Answers 4. Future Value of an Annuity. Kirk can take his $1,190 income tax refund and Invest it in a 36-month certificate of deposit at 8%, or he can use the money to purchase a home entertainment system and put $41 a month in a savings account that will pay him 8%. Which choice will give him more money at the end of 3 years? A. With the monthly saving option, he would have $1,702.68 in 3 years. If he put the money in a 36-month CD at 8%, he will have $1,585.35 B. With the monthly saving option, he would have $1,511.58 in 3 years. If he put the money in a 36-month CD at 8%, he will have $1,661.96 C. With the monthly saving option, he would have $1,661.96 in 3 years If he put the money in a 36-month CD at 8%, he will have $1,511.58 . . Normal No Spacing Heading 1 . D. With the monthly saving option, he would have $1,585.35 in 3 years. If he put the money in a 36-month CD at 8%, he will have $1,702.68 Answer 5. Estimating the Annuity Amount. Amy and Vince want to save $9,000 so they can take a trip to Europe in 4 years. How much must they save each month to have the money they need if they can get 8% on their savings? Answer 6. Time Value of Savings. http://www.dinkytown.net/java/CompoundSavings.html Use the Compound Savings Calculator to answer this question: Start by entering these values: Starting amount = 0 . Years to Save = 40 Rate of Return = 7% Additional contributions - $100 Frequency - per month Interest - compound annually. What will be your estimated total after 40 years? Answer Change the Years to Save to 35. Now what is your total? Answer How much did you give up by waiting 5 years to start saving for retirement? Answer What percentage reduction was this amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts