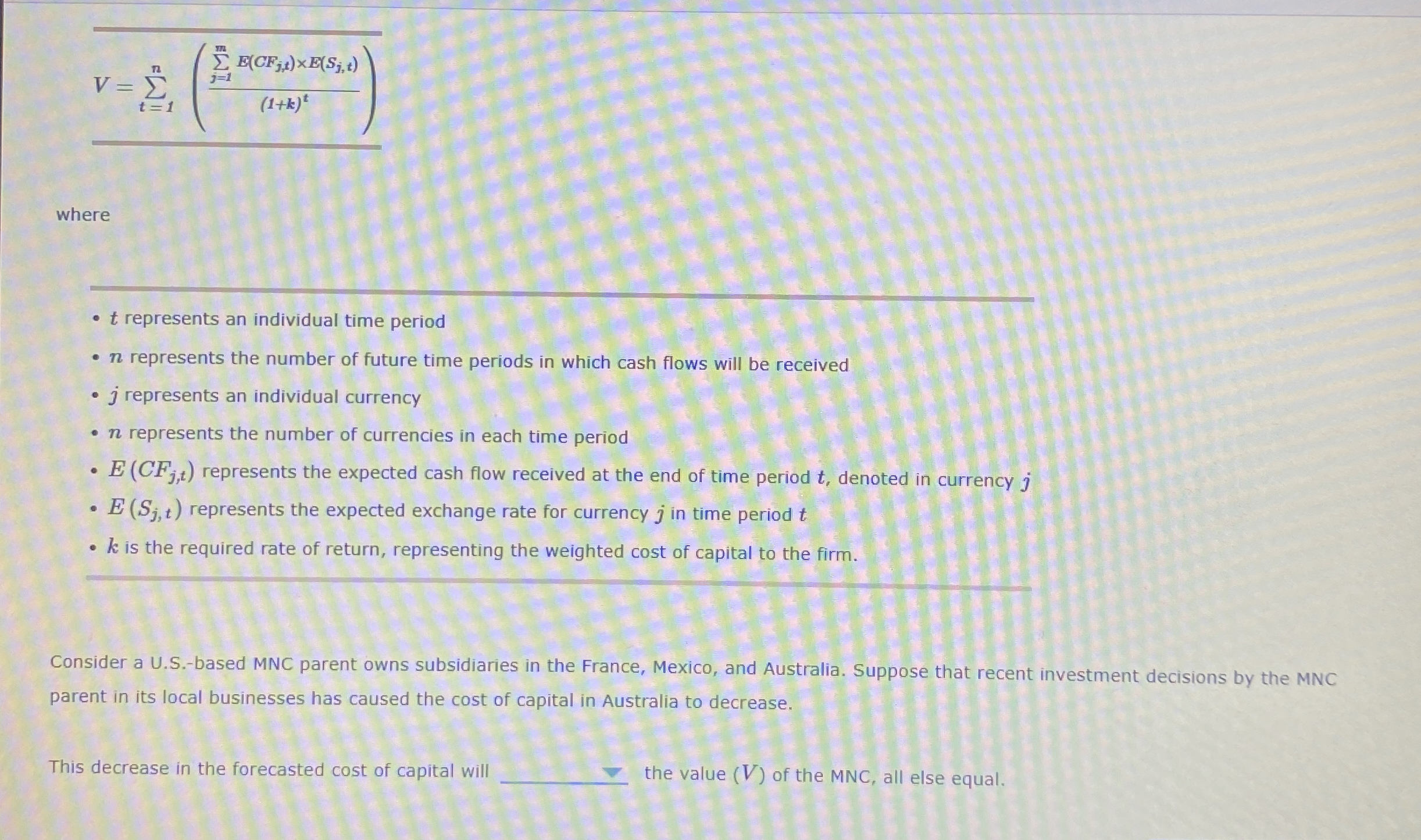

Question: V = t = 1 n ( j = 1 m E ( C F j , t ) E ( S j , t

where

represents an individual time period

represents the number of future time periods in which cash flows will be received

represents an individual currency

represents the number of currencies in each time period

represents the expected cash flow received at the end of time period denoted in currency

represents the expected exchange rate for currency in time period

is the required rate of return, representing the weighted cost of capital to the firm.

Consider a USbased MNC parent owns subsidiaries in the France, Mexico, and Australia. Suppose that recent investment decisions by the MNC parent in its local businesses has caused the cost of capital in Australia to decrease.

This decrease in the forecasted cost of capital will the value of the MNC all else equal.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock