Question: v u project Req le for is NPV: positive for NP MA101-FINANCIAL MANAGEMENT I KAMINATION PAPER-2018 SECOND SEMESTER 2 Appliances (Pty) Ltd is a retailer

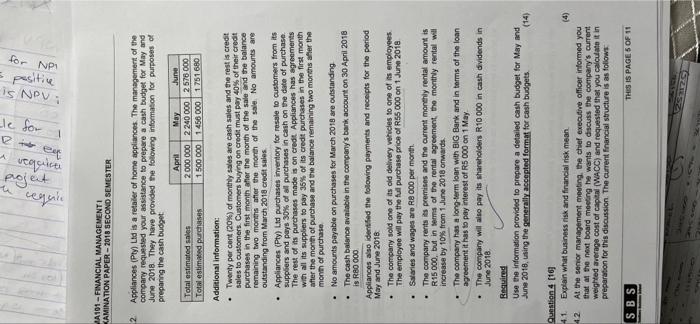

u project Req le for is NPV: positive for NP MA101-FINANCIAL MANAGEMENT I KAMINATION PAPER-2018 SECOND SEMESTER 2 Appliances (Pty) Ltd is a retailer of home appliances. The management of the company requested your assistance to prepare a cash budget for May and June 2018. They have provided the following information for purposes of preparing the cash budget April 2 000 000 May Total estimated sales 2 240 000 June 2 576 000 1751 680 Total estimated purchases 1 500 000 1456 000 Additional information: . Twenty per cent (20%) of monthly sales are cash sales and the rest is credit sales to customers. Customers buying on credit must pay 40% of their credit purchases in the first month after the month of the sale and the balance remaining two months after the month of the sale. No amounts are outstanding from March 2018 credit sales Appliances (Pty) Ltd purchases inventory for resale to customers from its suppliers and pays 30% of all purchases in cash on the date of purchase. The rest of its purchases made is on credit Appliances has agreements with all its suppliers to pay 35% of its credit purchases in the first month after the month of purchase and the balance remaining two months after the month of purchase No amounts payable on purchases for March 2018 are outstanding The cash balance available in the company's bank account on 30 April 2018 is R80 000 " Appliances also identified the following payments and receipts for the period May and June 2018 . The company sold one of its old delivery vehicles to one of its employees. The employee will pay the full purchase price of R55 000 on 1 June 2018 . Salaries and wages are R8 000 per month. The company rents its premises and the current monthly rental amount is R15 000, but in terms of the rental agreement, the monthly rental will increase by 10% from 1 June 2018 onwards. The company has a long-term loan with BIG Bank and in terms of the loan agreement it has to pay interest of R5 000 on 1 May The company will also pay its shareholders R10 000 in cash dividends in June 2018. Required Use the information provided to prepare a detailed cash budget for May and June 2018, using the generally accepted format for cash budgets. (14) Question 4 [16] 4.1. Explain what business risk and financial risk mean (4) 42 At the senior management meeting, the chief executive officer informed you that at the next board meeting he wants to discuss the company's current weighted average cost of capital (WACC) and requested that you calculate it in preparation for this discussion. The current financial structure is as follows: SBS] THIS IS PAGE 5 OF 11 CICE 1251129 30540 600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts