Question: V1 Test Ch. 17, 22 Accounting 4B Section II BITCO designs custom showroom spaces in interior design marts across the country The following data pertain

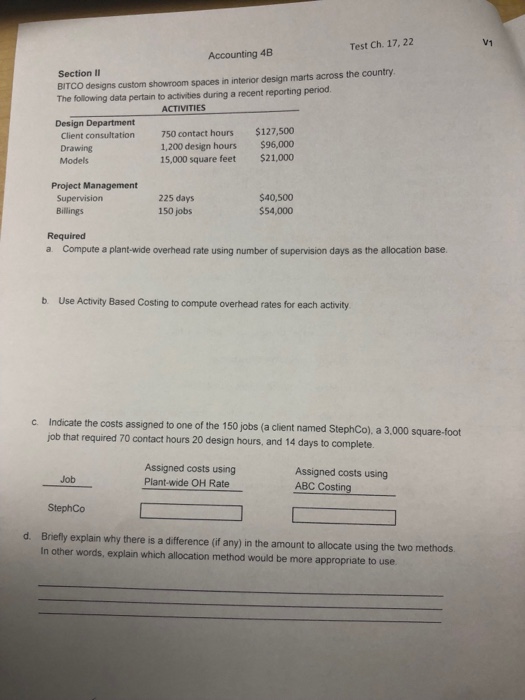

V1 Test Ch. 17, 22 Accounting 4B Section II BITCO designs custom showroom spaces in interior design marts across the country The following data pertain to activities during a recent reporting period ACTIVITIES Design Department Client consultation Drawing Models 750 contact hours 1,200 design hours 15,000 square feet $127,500 $96,000 $21,000 Project Management Supervision Billings 225 days 150 jobs $40,500 $54,000 Required a Compute a plant-wide overhead rate using number of supervision days as the allocation base b Use Activity Based Costing to compute overhead rates for each activity c Indicate the costs assigned to one of the 150 jobs (a client named StephCo), a 3,000 square-foot job that required 70 contact hours 20 design hours, and 14 days to complete Assigned costs using Plant-wide OH Rate Assigned costs using ABC Costing Job StephCo d. Briefly explain why there is a difference (if any) in the amount to allocate using the two methods In other words, explain which allocation method would be more appropriate to use

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts