Question: v2.cengagenow.com C Comparison of the Direct Write-off and Allowance Methods of Accounting for Bad Debts In its first year of business, Rideaway Bikes has net

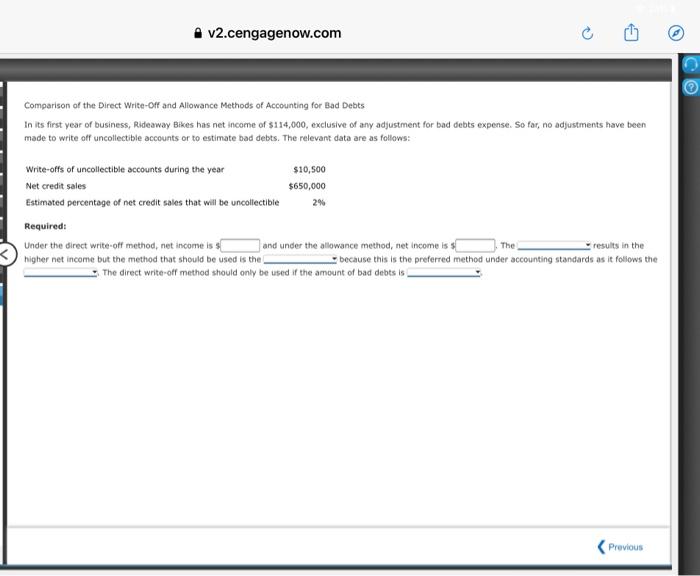

v2.cengagenow.com C Comparison of the Direct Write-off and Allowance Methods of Accounting for Bad Debts In its first year of business, Rideaway Bikes has net income of $114,000, exclusive of any adjustment for bad debts expense. So far, no adjustments have been made to write off uncollectible accounts or to estimate bad debts. The relevant data are as follows: Write-offs of uncollectible accounts during the year $10,500 Net credit sales $650,000 Estimated percentage of net credit sales that will be uncollectible 2% Required: Under the direct write-off method, net income iss and under the allowance method, net income is $ The results in the higher net income but the method that should be used is the because this is the preferred method under accounting standards as it follows the The direct write-off method should only be used if the amount of bad debts is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts