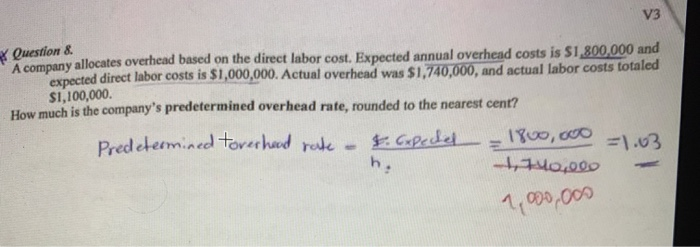

Question: V3 Question & A company allocates overhead based on the direct labor cost. Expected annual overhead costs is $1,800,000 and expected direct labor costs is

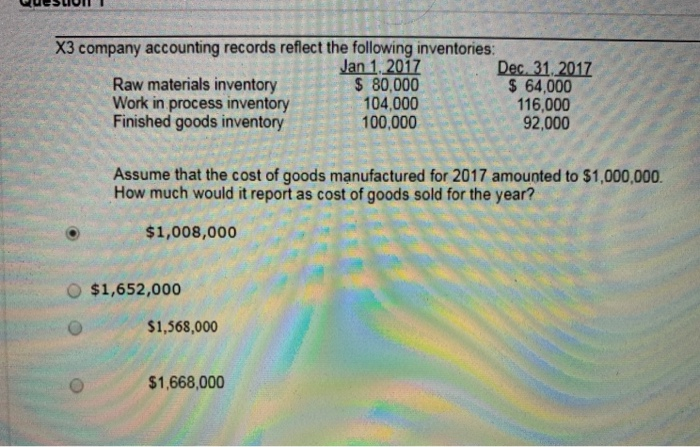

V3 Question & A company allocates overhead based on the direct labor cost. Expected annual overhead costs is $1,800,000 and expected direct labor costs is $1,000,000. Actual overhead was $1,740,000, and actual labor costs totaled $1,100,000 How much is the company's predetermined overhead rate, rounded to the nearest cent? Predetermined toverhead raate - 3. Expected -L, 70,000 1800, WO =1.03 h: 1,000,000 X3 company accounting records reflect the following inventories: Jan 1, 2017 Dec 31, 2017 Raw materials inventory $ 80,000 $ 64,000 Work in process inventory 104,000 116,000 Finished goods inventory 100,000 92,000 Assume that the cost of goods manufactured for 2017 amounted to $1,000,000 How much would it report as cost of goods sold for the year? $1,008,000 $1,652,000 $1,568,000 $1,668,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts