Question: . . VAA A. X, * Aay. A 21 Du. AaBbCcDc AaBbccdc AaBbc AaBbccc Normal TNo Spac... Heading 1 Heading 2 Font Paragraph Styles Complete

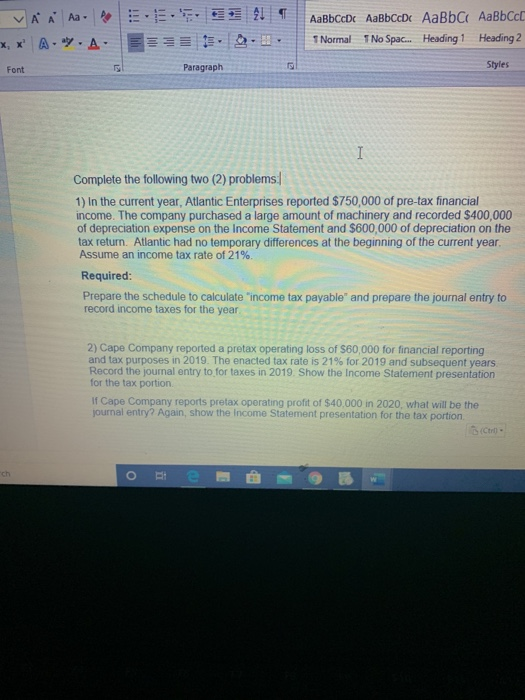

. . VAA A. X, * Aay. A 21 Du. AaBbCcDc AaBbccdc AaBbc AaBbccc Normal TNo Spac... Heading 1 Heading 2 Font Paragraph Styles Complete the following two (2) problems: 1) In the current year, Atlantic Enterprises reported $750,000 of pre-tax financial income. The company purchased a large amount of machinery and recorded $400,000 of depreciation expense on the Income Statement and $600,000 of depreciation on the tax return. Atlantic had no temporary differences at the beginning of the current year Assume an income tax rate of 21%. Required: Prepare the schedule to calculate income tax payable" and prepare the journal entry to record income taxes for the year 2) Cape Company reported a pretax operating loss of $60,000 for financial reporting and tax purposes in 2019. The enacted tax rate is 21% for 2019 and subsequent years Record the journal entry to for taxes in 2019. Show the Income Statement presentation for the tax portion If Cape Company reports pretax operating profit of $40,000 in 2020, what will be the journal entry? Again, show the income Statement presentation for the tax portion (Ctrl

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts