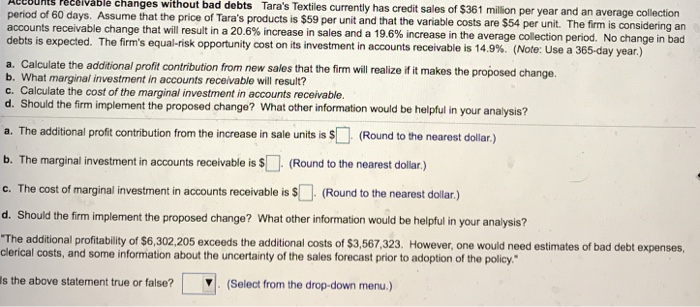

Question: vable changes without bad debts Tara's Textiles currently has credit sales of $361 million per year and an average collection period of 60 days. Assume

vable changes without bad debts Tara's Textiles currently has credit sales of $361 million per year and an average collection period of 60 days. Assume that the price of Tara's products is $59 per unit and that the variable costs are $54 per unit. The firm is considering an accounts receivable change that will result in a 20.6 % increase in sales and a 19.6 % increase in the average collection period. No change in bad debts is expected. The firm's equal-risk opportunity cost on its investment in accounts receivable is 14.9 %. (Note: Use a 365-day year.) a. Calculate the additional profit contribution from new sales that the firm will realize if it makes the proposed change. b. What marginal investment in accounts receivable will result? c. Calculate the cost of the marginal investment in accounts receivable. d. Should the firm implement the proposed change? What other information would be helpful in your analysis? a. The additional profit contribution from the increase in sale units is S (Round to the nearest dollar.) b. The marginal investment in accounts receivable is $(Round to the nearest dollar.) c. The cost of marginal investment in accounts receivable is $ (Round to the nearest dollar.) d. Should the firm implement the proposed change? What other information would be helpful in your analysis? The additional profitability of $6,302,205 exceeds the additional costs of $3,567,323. However, one would need estimates of bad debt expenses, clerical costs, and some information about the uncertainty of the sales forecast prior to adoption of the policy. s the above statement true or false? (Select from the drop-down menu.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts