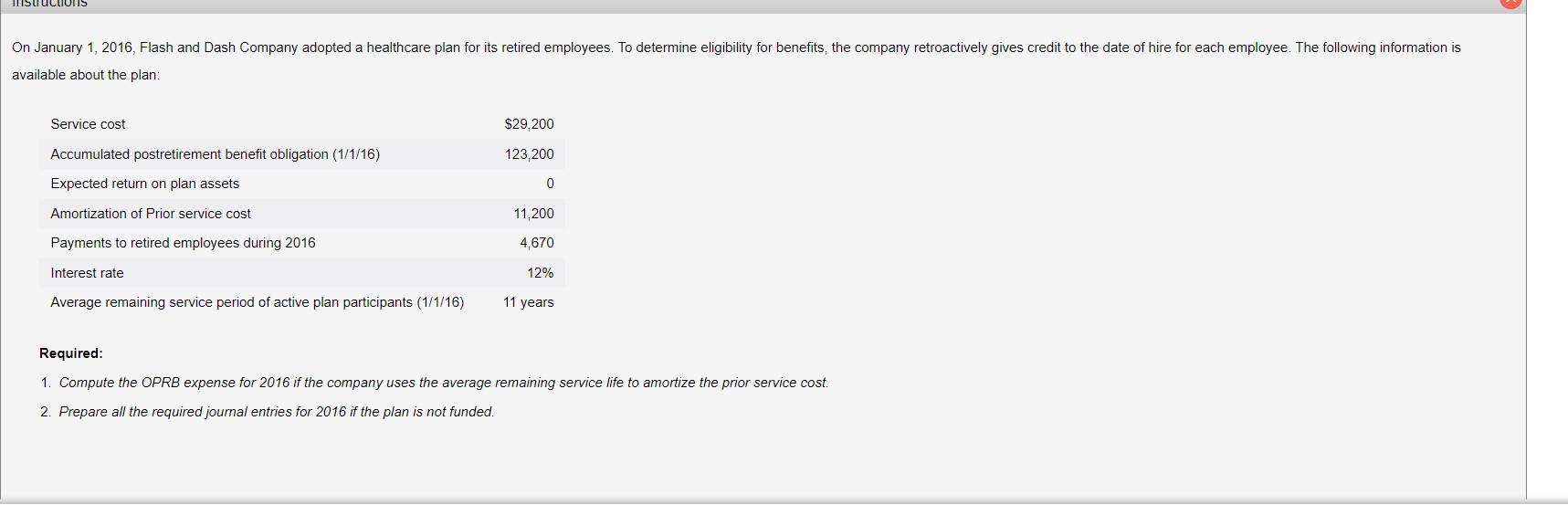

Question: vailable about the plan: Required: 1. Compute the OPRB expense for 2016 if the company uses the average remaining service life to amortize the prior

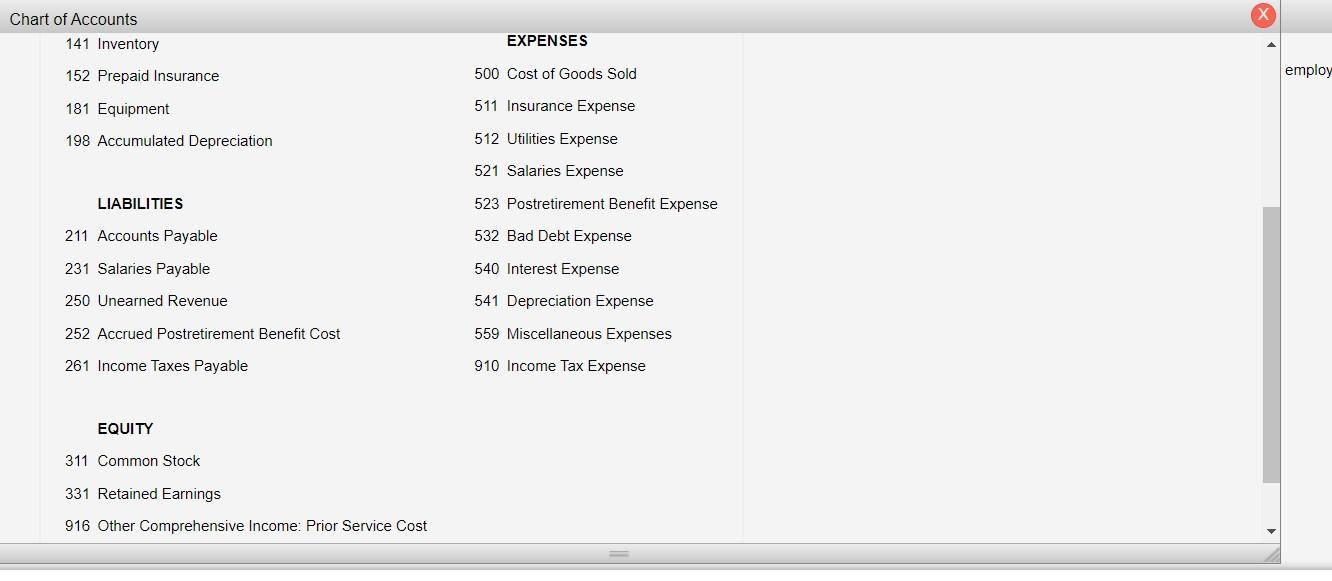

vailable about the plan: Required: 1. Compute the OPRB expense for 2016 if the company uses the average remaining service life to amortize the prior service cost. 2. Prepare all the required journal entries for 2016 if the plan is not funded. Chart of Accounts 141 Inventory EXPENSES 152 Prepaid Insurance 500 Cost of Goods Sold 181 Equipment 511 Insurance Expense 198 Accumulated Depreciation 512 Utilities Expense 521 Salaries Expense LIABILITIES 523 Postretirement Benefit Expense 211 Accounts Payable 532 Bad Debt Expense 231 Salaries Payable 540 Interest Expense 250 Unearned Revenue 541 Depreciation Expense 252 Accrued Postretirement Benefit Cost 559 Miscellaneous Expenses 261 Income Taxes Payable 910 Income Tax Expense EQUITY 311 Common Stock 331 Retained Earnings 916 Other Comprehensive Income: Prior Service Cost Prepare the entries to record: 1. the prior service cost on January 1. 2. the postretirement benefit expense for 2016 on December 31. 3. the payments to retired employees during 2016 on December 31 . 4. the amortization of prior service cost on December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts