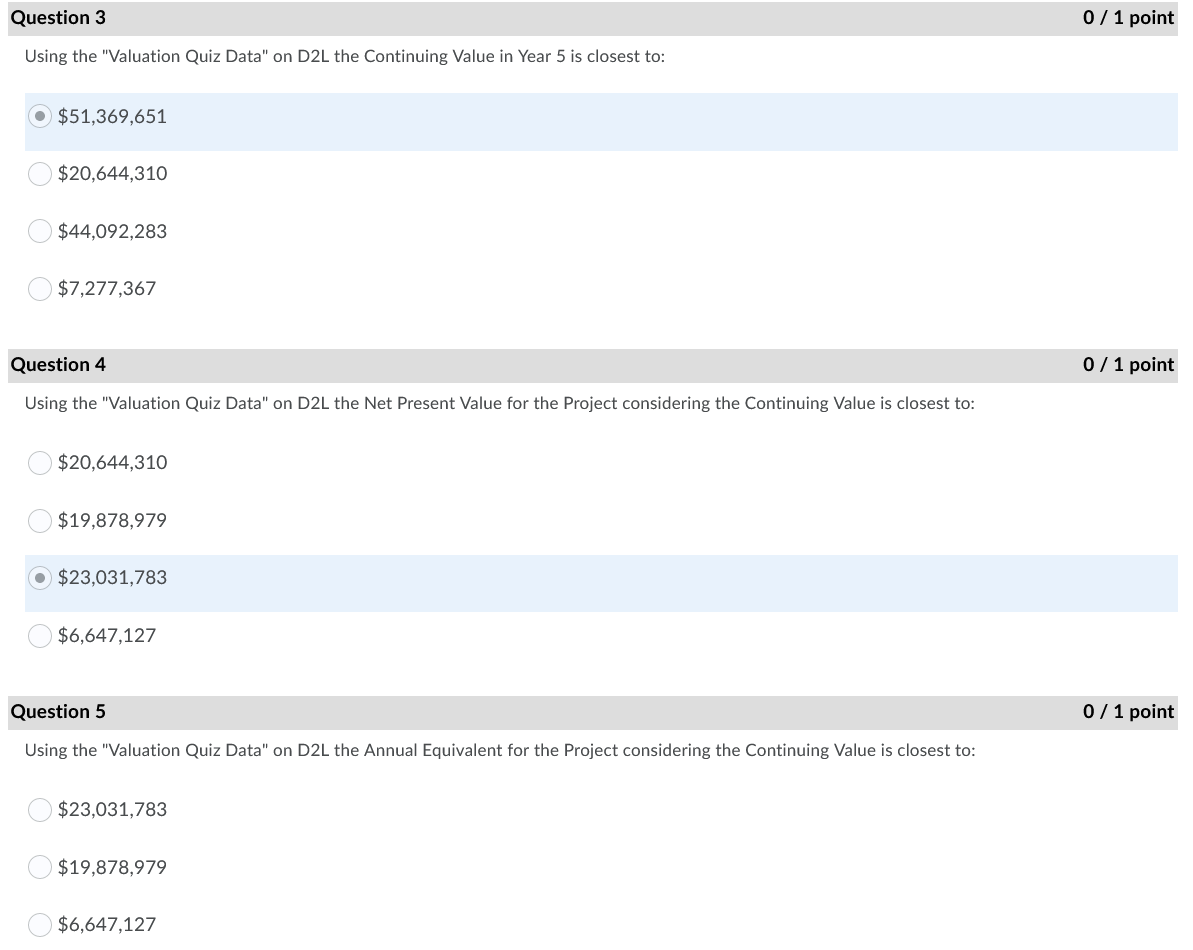

Question: Valuation Calculations Year 0 1 Cash Flow before Equity Financing Discounted Cash Flow $0 Valuation of a finite life Enterprise 2 3 ($700,000) ($100,000)

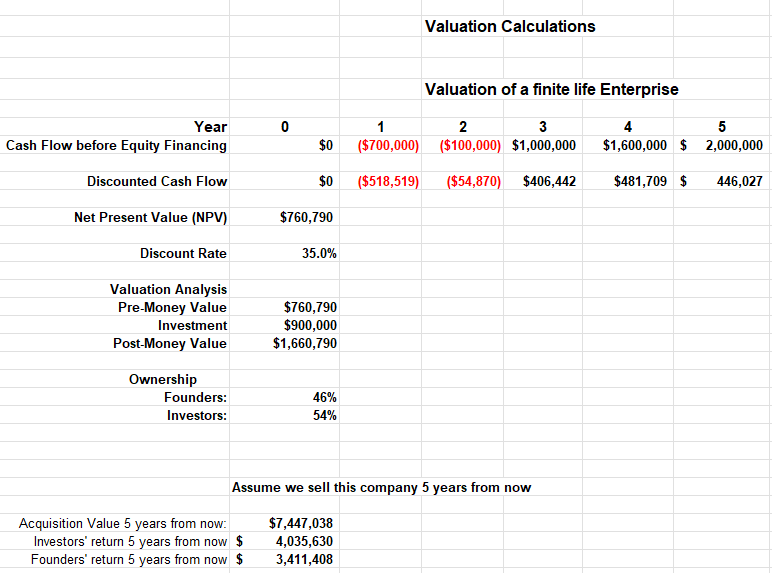

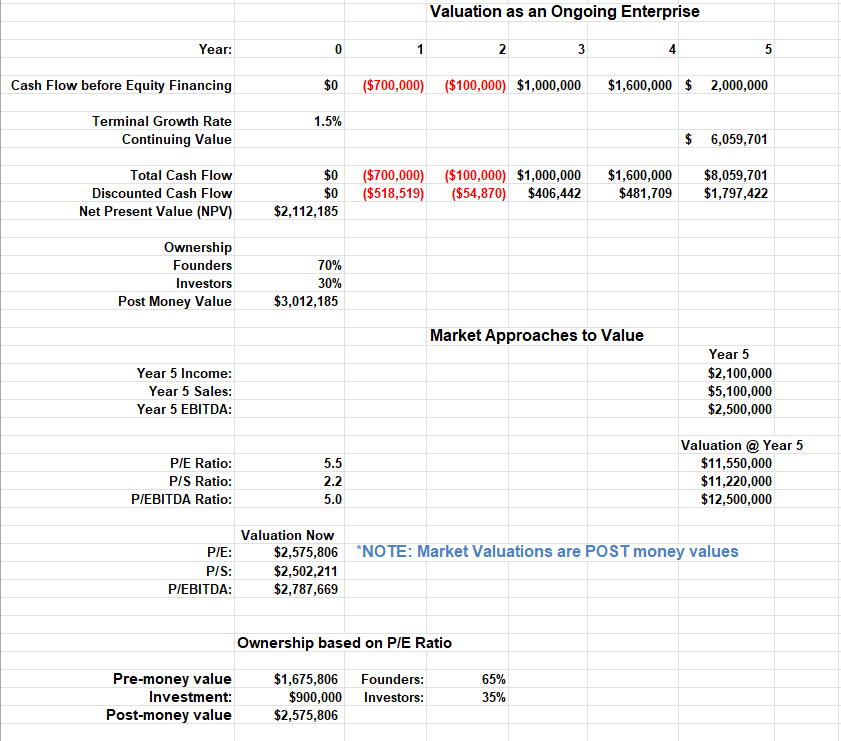

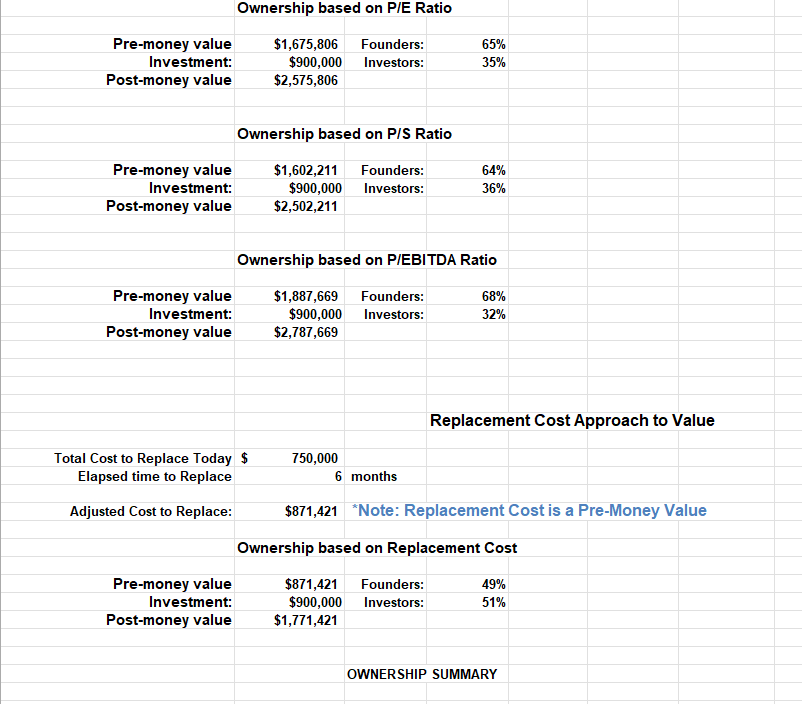

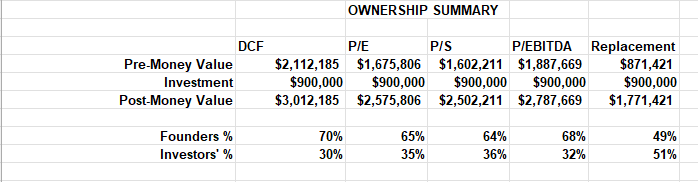

Valuation Calculations Year 0 1 Cash Flow before Equity Financing Discounted Cash Flow $0 Valuation of a finite life Enterprise 2 3 ($700,000) ($100,000) $1,000,000 5 4 $1,600,000 $2,000,000 $0 ($518,519) ($54,870) $406,442 $481,709 $ 446,027 Net Present Value (NPV) $760,790 Discount Rate 35.0% Valuation Analysis Pre-Money Value $760,790 Investment $900,000 Post-Money Value $1,660,790 Ownership Founders: Investors: 46% 54% Assume we sell this company 5 years from now Acquisition Value 5 years from now: Investors' return 5 years from now $ Founders' return 5 years from now $ $7,447,038 4,035,630 3,411,408

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts