Question: Valuation - Given the distribution inputs you defined, calculate the value of your REIT per share and explain your approach. Then, using the REIT's value

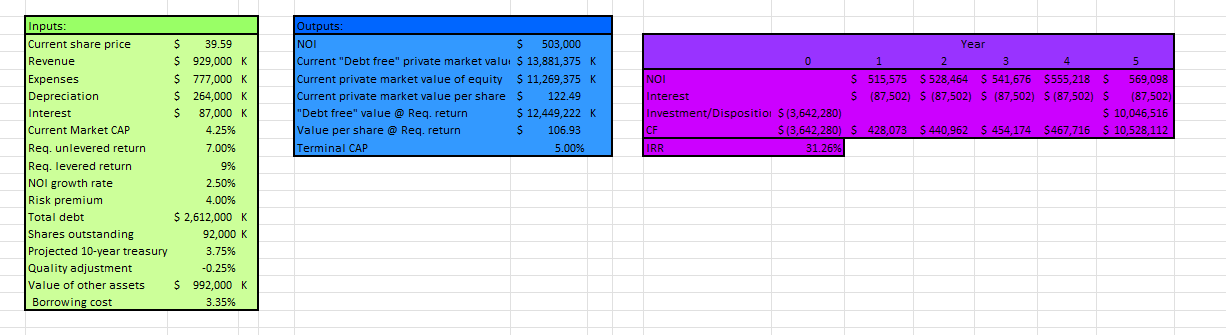

Valuation - Given the distribution inputs you defined, calculate the value of your REIT per share and explain your approach. Then, using the REIT's value as an entry point for potential investors, answer the following questions: - What is the probability that investors will earn a rate of return that is at least as high as their required rate of return? - What is the probability that investors will earn a rate of return of at least 8% per year? - What is the probability that investors will recognize an investment loss greater than 2% per year? Please answer in a style using the excel below, the REIT i chose was UDR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts