Question: Valuation model. e node he top row You are valuing an employee stock option using a trinomial lattice and the Hull-White ESO valuation model. The

Valuation

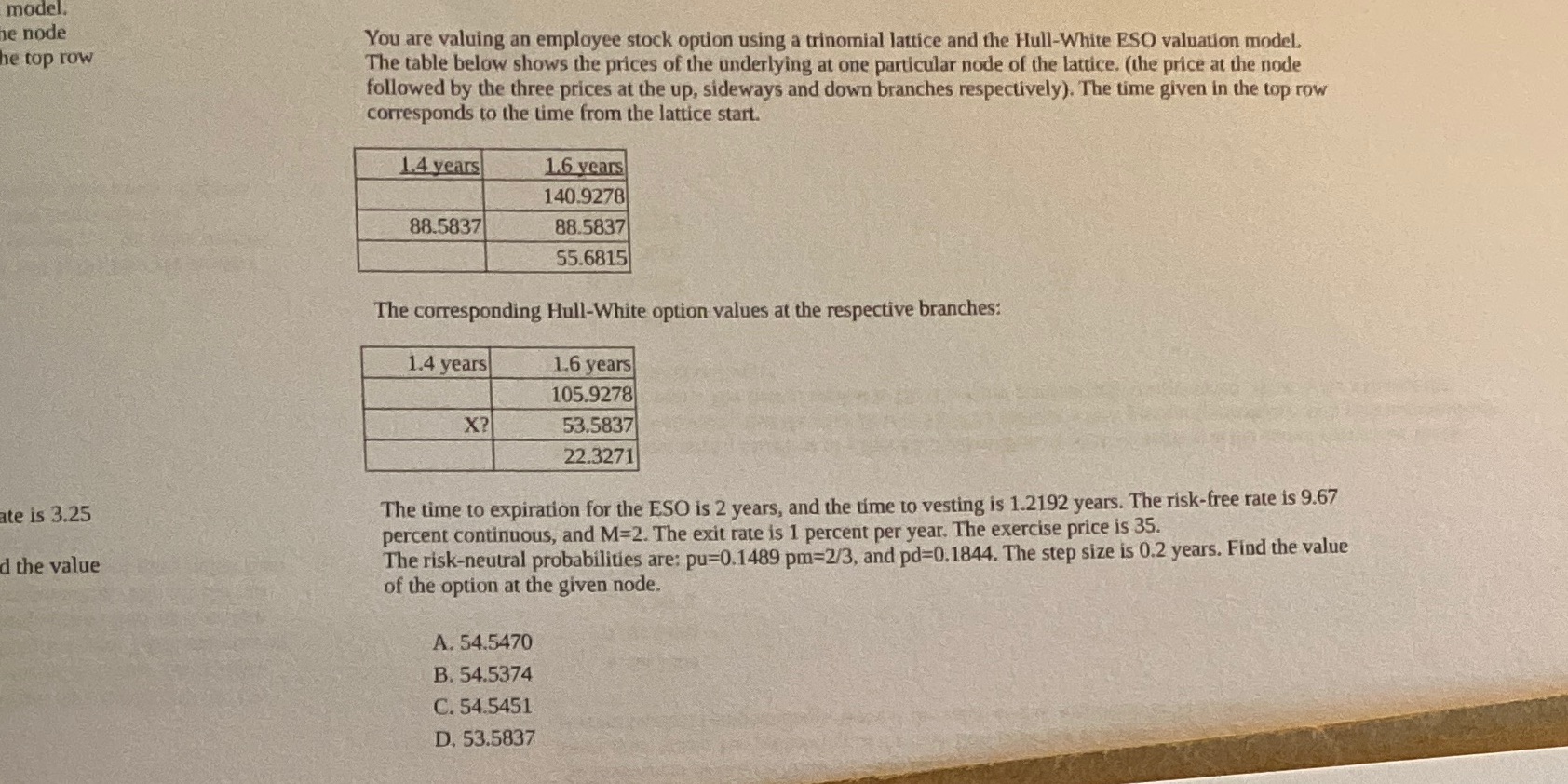

model. e node he top row You are valuing an employee stock option using a trinomial lattice and the Hull-White ESO valuation model. The table below shows the prices of the underlying at one particular node of the lattice. (the price at the node followed by the three prices at the up, sideways and down branches respectively). The time given in the top row corresponds to the time from the lattice start. 1.4 years 1.6 years 140.9278 88.5837 88.5837 55.6815 The corresponding Hull-White option values at the respective branches: 1.4 years 1.6 years 105.9278 X? 53.5837 22.3271 ate is 3.25 The time to expiration for the ESO is 2 years, and the time to vesting is 1.2192 years. The risk-free rate is 9.67 percent continuous, and M=2. The exit rate is 1 percent per year. The exercise price is 35. d the value The risk-neutral probabilities are: pu=0.1489 pm=2/3, and pd=0.1844. The step size is 0.2 years. Find the value of the option at the given node. A. 54.5470 B. 54.5374 C. 54.5451 D. 53.5837

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts