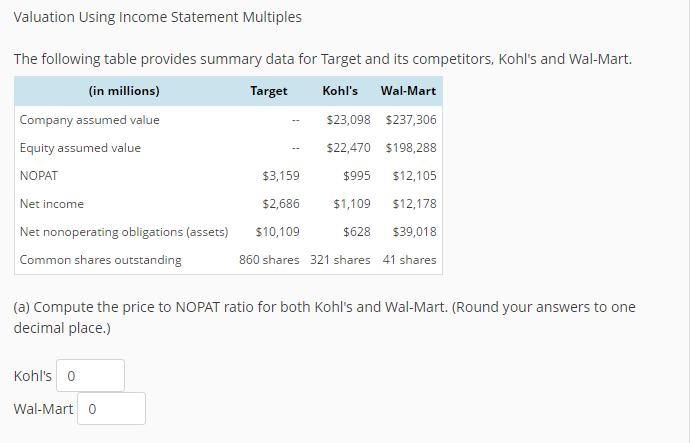

Question: Valuation Using Income Statement Multiples The following table provides summary data for Target and its competitors, Kohl's and Wal-Mart. in millions) $23,098 $237,306 $22,470 $198,288

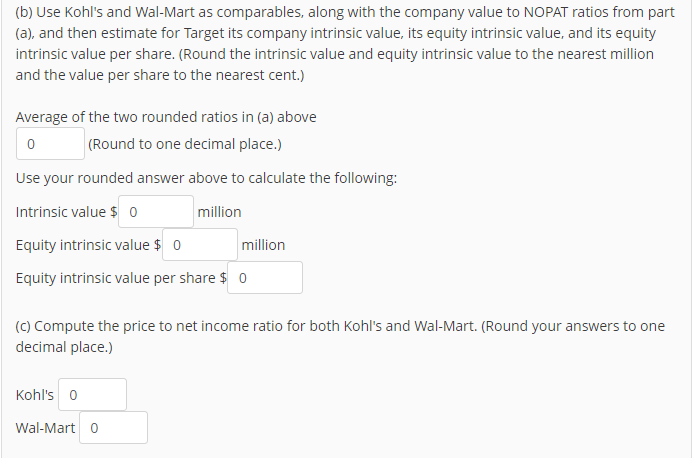

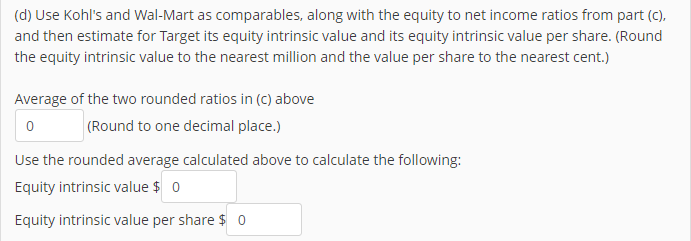

Valuation Using Income Statement Multiples The following table provides summary data for Target and its competitors, Kohl's and Wal-Mart. in millions) $23,098 $237,306 $22,470 $198,288 3,159 $995 $12,105 $2,686 $1,109 $12,178 Net nonoperating obligations (assets) $10,109 $628 $39,018 Company assumed value Equity assumed value NOPAT Net income 860 shares 321 shares 41 shares (a) Compute the price to NOPAT ratio for both Kohl's and Wal-Mart. (Round your answers to one decimal place.) Kohl's 0 Wal-Mart 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts