Question: value 0.23 points M9-4 Computing Book Value (Straight-Line Depreciation) [LO 9-3] A machine that cost $126,500 has an estimated residual value of $5,500 and an

![value 0.23 points M9-4 Computing Book Value (Straight-Line Depreciation) [LO 9-3]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e56d9b3986e_83466e56d9a707c8.jpg)

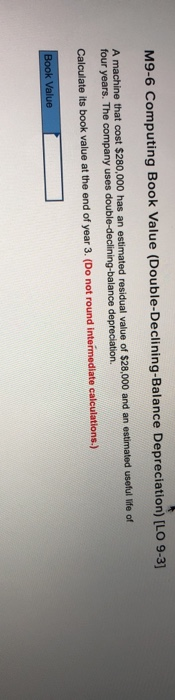

value 0.23 points M9-4 Computing Book Value (Straight-Line Depreciation) [LO 9-3] A machine that cost $126,500 has an estimated residual value of $5,500 and an estimated useful life of eleven years. The company uses straight-line depreciation. Calculate its book value at the end of year 9. (Do not round intermediate calculations.) $17,600 Book Value References eBook & Resources M9-6 Computing Book Value (Double-Declining-Balance Depreciation) [LO 9-3] A machine that cost $280,000 has an estimated residual value of $28,000 and an estimated useful life of lance depreciation. Calculate its book value at the end of year 3. (Do not round intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts