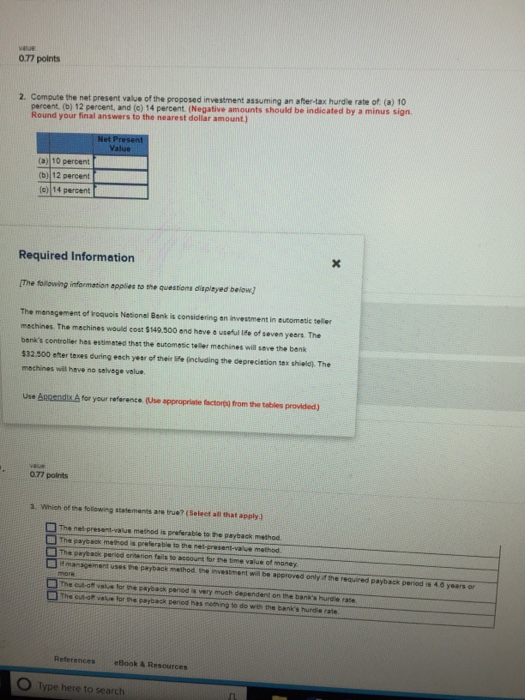

Question: value 077 points 2. Compute the net present value of the proposed investment assu ming an after-tax hurdle rate of (a) 10 percent. (b) 12

value 077 points 2. Compute the net present value of the proposed investment assu ming an after-tax hurdle rate of (a) 10 percent. (b) 12 percent, and (c) 14 percent. (Negative amounts should be indicated by a minus sign Round your final answers to the nearest dollar amount) (a) 10 percent (b) 12 percent (c) 14 percent Required Information The foilowing information applies to the quessions displeyed below The manegement of voquois Nesionel Benk is considering an invessment in eutometic teller machines The mechines would cost Su9.500 end heveuseM lte or seven years. The benk's controller hos estimeted thet the sutomesic teller mechines will seve the bank $32.500 eter texes during each yeer of their ife (including the deprecistion tex shield) The machines will heve no selvage value Use Angendlix & for your reference (Use appropriate factorb) from the tables provided) 0.77 points 1, which of the fotowng statemonts artrue? (Select all that apply.) Th. net-present-value method is pre%rable to ho payback method. The peyeack peried errion ailto account for the time value of money - anager em uses he payback method ee nvestment w a be approved only re vred payback perod-45 years or The et-o" vsufor re paye.ck penod-very much dependent on the bank's hurdle rate The cut-off value for the payback period hes nothing to do with the bank's hurde rate. References eBook & Resources Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts