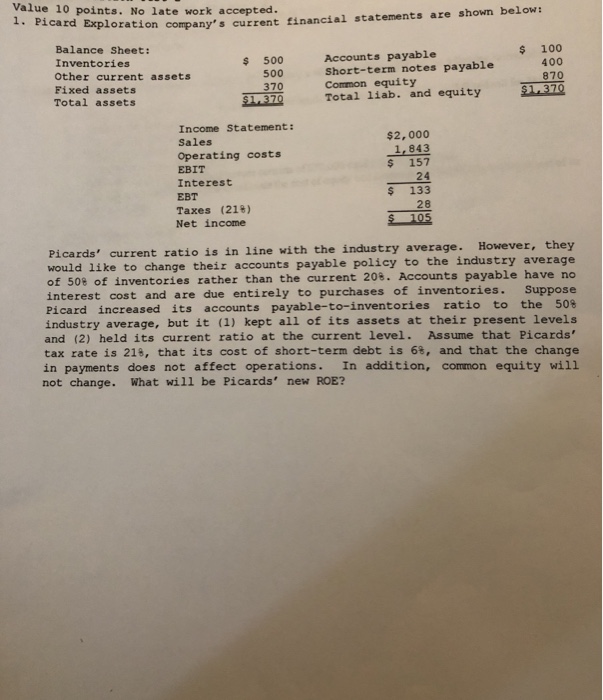

Question: Value 10 points. No late work accepted. 1. Picard Expl oration company's current financial statements are shown below: Balance Sheet: Inventories Other current assets Fixed

Value 10 points. No late work accepted. 1. Picard Expl oration company's current financial statements are shown below: Balance Sheet: Inventories Other current assets Fixed assets Total assets $ 500 500 370 1 37 Accounts payable Short-term notes payable Common equity Total liab. and equity $ 100 400 870 370 Income Statement: Sales Operating costs EBIT Interest EBT Taxes (21%) Net income $2,000 1, 843 $ 157 24 $ 133 28 Picards' current ratio is in line with the industry average. However, they would like to change their accounts payable policy to the industry average of 50% of inventories rather than the current 20%. Accounts payable have no interest cost and are due entirely to purchases of inventories. Suppose Picard increased its accounts payable-to-inventories ratio to the 50% industry average, but it (1) kept all of its assets at their present levels and (2) held its current ratio at the current level. Assume that Picards' tax rate is 218, that its cost of short-term debt is 68, and that the change in payments does not affect operations. In addition, common equity will not change. What will be Picards' new ROE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts