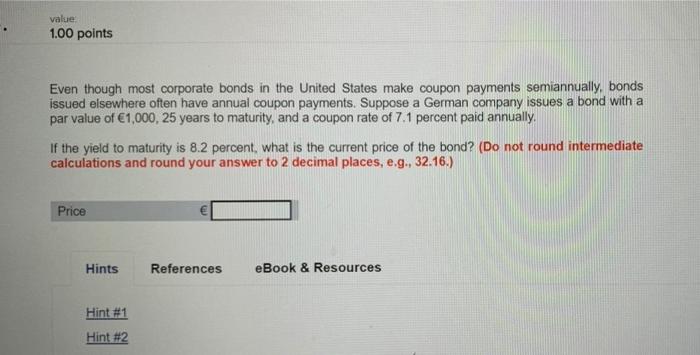

Question: value 1.00 points Even though most corporate bonds in the United States make coupon payments semiannually bonds issued elsewhere often have annual coupon payments. Suppose

value 1.00 points Even though most corporate bonds in the United States make coupon payments semiannually bonds issued elsewhere often have annual coupon payments. Suppose a German company issues a bond with a par value of 1,000, 25 years to maturity, and a coupon rate of 7.1 percent paid annually. If the yield to maturity is 8.2 percent, what is the current price of the bond? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Price Hints References eBook & Resources Hint #1 Hint #2

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock