Question: value 10.00 points Peridot Developers Ltd began operations in December 2012. Peridot sells plots of land for industrial development. Peridot recognizes income for financial reporting

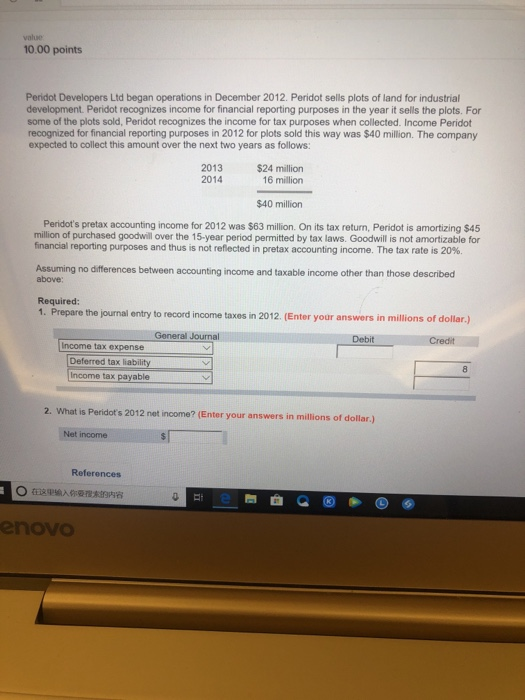

value 10.00 points Peridot Developers Ltd began operations in December 2012. Peridot sells plots of land for industrial development. Peridot recognizes income for financial reporting purposes in the year it sells the plots. For some of the plots sold, Peridot recognizes the income for tax purposes when collected. Income Peridot recognized for financial reporting purposes in 2012 for plots sold this way was $40 million. The company expected to collect this amount over the next two years as follows: 2013 2014 $24 million 16 million $40 million Peridot's pretax accounting income for 2012 was $63 million. On its tax return, Peridot is amortizing $45 million of purchased goodwill over the 15-year period permitted by tax laws. Goodwill is not amortizable for financial reporting purposes and thus is not reflected in pretax accounting income. The tax rate is 20%. Assuming no differences between accounting income and taxable income other than those described above: Required: 1. Prepare the journal entry to record income taxes in 2012. (Enter your answers in millions of dollar.) General Journal Debit Income tax expense Deferred tax liability Income tax payable 2. What is Peridot's 2012 net income? (Enter your answers in millions of dollar.) Net income References 19A8 enovO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts