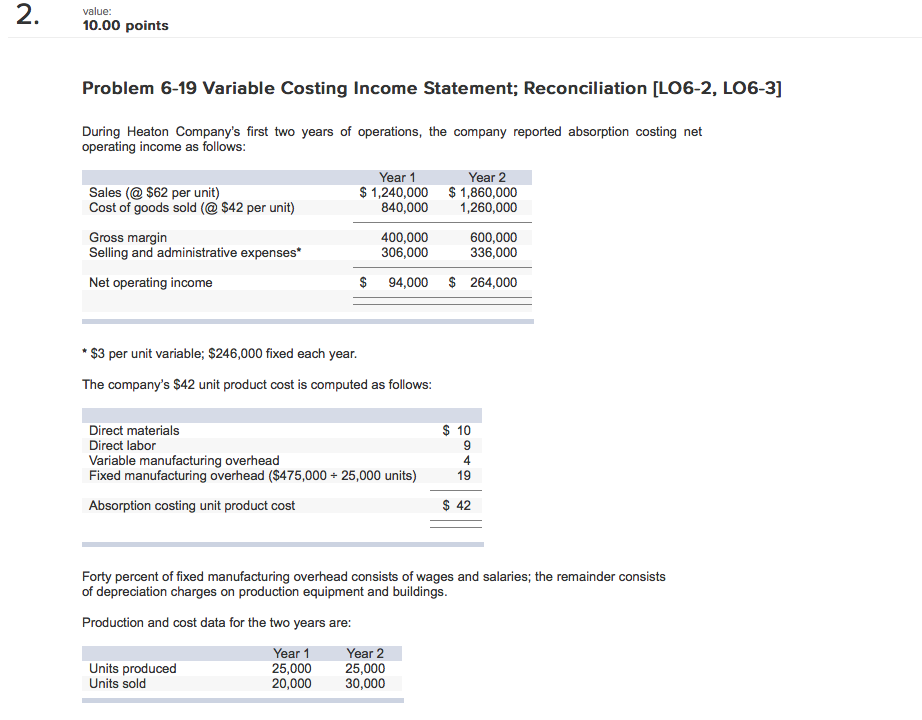

Question: value: 10.00 points Problem 6-19 Variable Costing Income Statement; Reconciliation ILO6-2, LO6-3] During Heaton Company's first two years of operations, the company reported absorption costing

![LO6-3] During Heaton Company's first two years of operations, the company reported](https://s3.amazonaws.com/si.experts.images/answers/2024/08/66cda79435df9_81166cda793cb6cd.jpg)

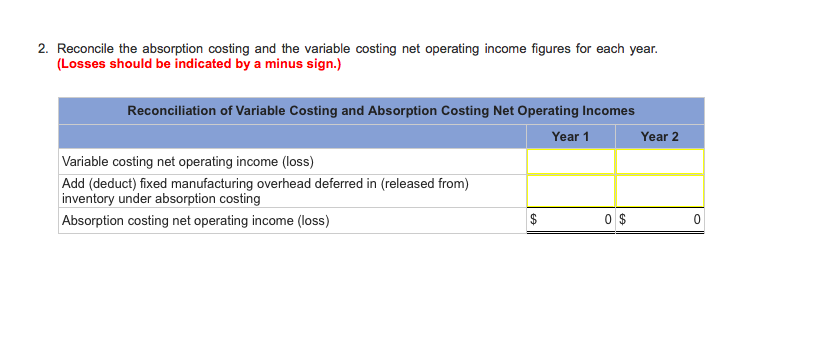

value: 10.00 points Problem 6-19 Variable Costing Income Statement; Reconciliation ILO6-2, LO6-3] During Heaton Company's first two years of operations, the company reported absorption costing net operating income as follows: Year 1 Year 2 Sales $62 per unit) 1,240,000 1,860,000 840,000 1,260,000 Cost of goods sold $42 per unit) 400,000 600,000 Gross margin 306,000 336,000 Selling and administrative expenses 94,000 264,000 Net operating income $3 per unit variable; $246,000 fixed each year. The company's $42 unit product cost is computed as follows: Direct materials 10 Direct labor Variable manufacturing overhead Fixed manufacturing overhead ($475,000 25,000 units) 19 42 Absorption costing unit product cost Forty percent of fixed manufacturing overhead consists of wages and salaries; the remainder consists of depreciation charges on production equipment and buildings Production and cost data for the two years are: Year 1 Year 2 Units produced 25,000 25,000 Units sold 20,000 30,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts