Question: value: 10.00 points Waller, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with 8 years to maturity

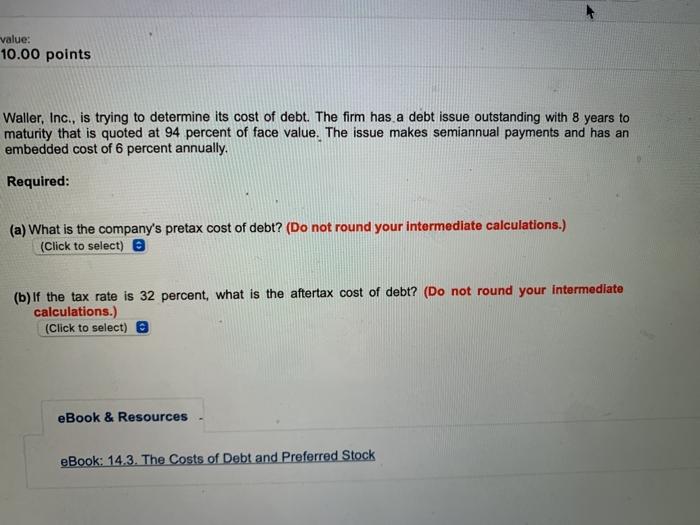

value: 10.00 points Waller, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with 8 years to maturity that is quoted at 94 percent of face value. The issue makes semiannual payments and has an embedded cost of 6 percent annually. Required: (a) What is the company's pretax cost of debt? (Do not round your intermediate calculations.) (Click to select) (b) If the tax rate is 32 percent, what is the aftertax cost of debt? (Do not round your intermediate calculations.) (Click to select) eBook & Resources eBook: 14.3. The Costs of Debt and Preferred Stock

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock