Question: value: 100.00 points Problem 16-1 EBIT and Leverage [LO1] RAK, Inc., has no debt outstanding and a total market value of $240,000. Earnings before interest

![value: 100.00 points Problem 16-1 EBIT and Leverage [LO1] RAK, Inc.,](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ec3dc335dc6_33866ec3dc28d86e.jpg)

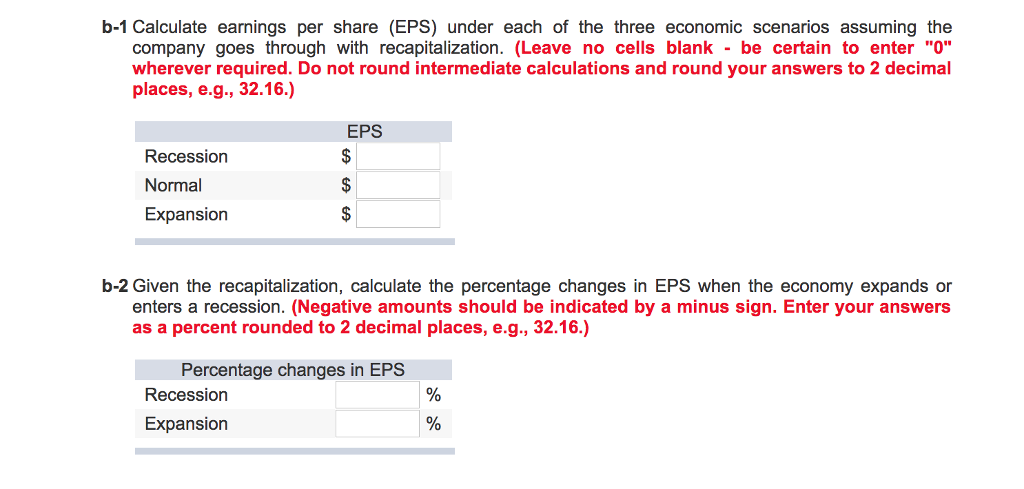

value: 100.00 points Problem 16-1 EBIT and Leverage [LO1] RAK, Inc., has no debt outstanding and a total market value of $240,000. Earnings before interest and taxes, EBIT, are projected to be $26,000 if economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 18 percent higher. If there is a recession, then EBIT will be 20 percent lower. RAK is considering a $150,000 debt issue with an interest rate of 8 percent. The proceeds will be used to repurchase shares of stock. There are currently 15,000 shares outstanding. lgnore taxes for this problem a-1 Calculate earnings per share (EPS) under each of the three economic scenarios before any debt is issued. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) EPS Recession Normal Expansion a-2 Calculate the percentage changes in EPS when the economy expands or enters a recession (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Percentage changes in EPS Recession Expansion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts