Question: value: 1.12 points Problem 12-14 Return on Investment (ROl) and Residual Income [LO12-1, L012-2] I know headquarters wants us to add that new product line,

![Income [LO12-1, L012-2] I know headquarters wants us to add that new](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f1ee9c32667_29166f1ee9bc5e00.jpg)

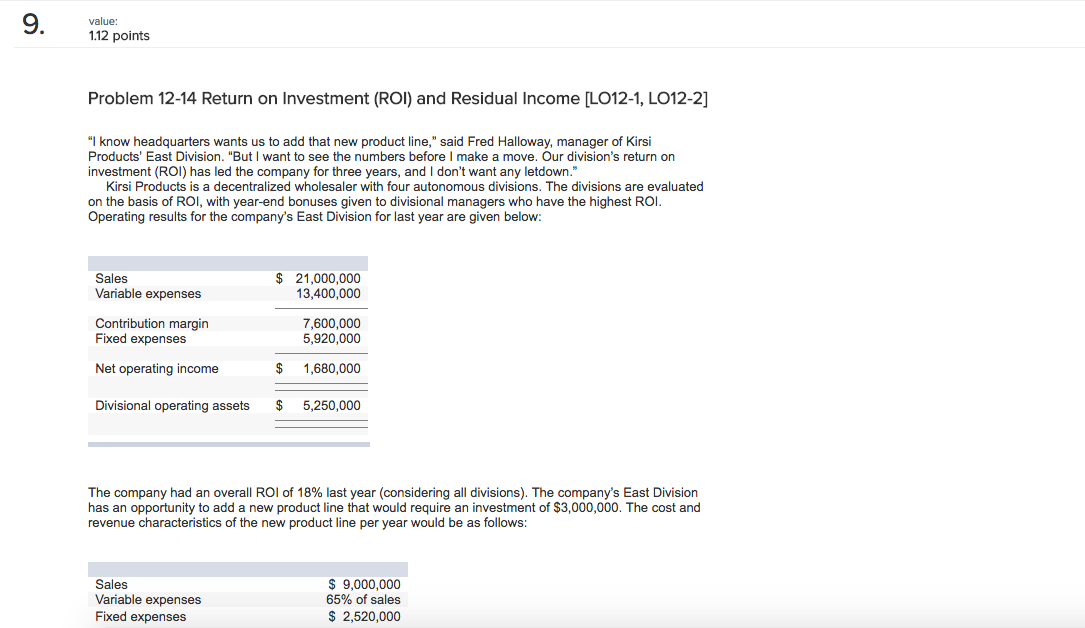

value: 1.12 points Problem 12-14 Return on Investment (ROl) and Residual Income [LO12-1, L012-2] I know headquarters wants us to add that new product line," said Fred Halloway, manager of Kirsi Products' East Division. "But I want to see the numbers before I make a move. Our division's return on investment (ROI) has led the company for three years, and I don't want any letdown." Kirsi Products is a decentralized wholesaler with four autonomous divisions. The divisions are evaluated on the basis of ROl, with year-end bonuses given to divisional managers who have the highest ROI Operating results for the company's East Division for last year are given below: Sales $ 21,000,000 Variable expenses 13,400,000 Contribution margin 7,600,000 Fixed expenses Net operating income Divisional operating assets 5,920,000 $1,680,000 5,250,000 $ The company had an overall ROI of 18% last year (considering all divisions). The company's East Division has an opportunity to add a new product line that would require an investment of $3,000,000. The cost and revenue characteristics of the new product line per year would be as follows Sales Variable expenses Fixed expenses $ 9,000,000 65% of sales S 2,520,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts