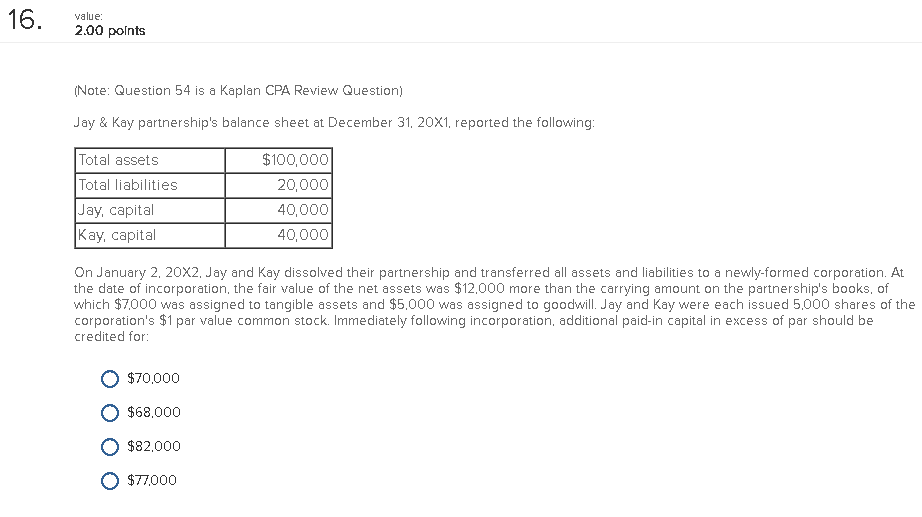

Question: value 2.00 polnts Note: Question 54 is a Kaplan CPA Review Question) Jay & Kay partnership's balance sheet at December 31, 20X1, reported the following

value 2.00 polnts Note: Question 54 is a Kaplan CPA Review Question) Jay & Kay partnership's balance sheet at December 31, 20X1, reported the following Total assets Total liabilities Jay, capital Kay, capital $100,000 20,000 40,000 40,000 On January 2. 20X2, Jay and Kay dissolved their partnership and transferred all assets and liabilities to a newly-formed corporation. At the date of incorporation, the fair value of the net assets was $12,000 more than the carrying amount on the partnership's books, of which $7000 was assigned to tangible assets and $5,000 was assigned to goodwill. Jay and Kay were each issued 5,000 shares of the corporation's $1 par value common stock. Immediately following incorporation, additional paid-in capital in excess of par should be credited for $70,000 $68,000 O $82.000 O $77000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts