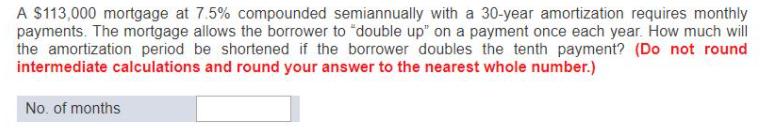

Question: A $113,000 mortgage at 7.5% compounded semiannually with a 30-year amortization requires monthly payments. The mortgage allows the borrower to double up on a

A $113,000 mortgage at 7.5% compounded semiannually with a 30-year amortization requires monthly payments. The mortgage allows the borrower to "double up" on a payment once each year. How much will the amortization period be shortened if the borrower doubles the tenth payment? (Do not round intermediate calculations and round your answer to the nearest whole number.) No. of months

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

To solve this problem we need to calculate the original monthly payment the effect of doubling the tenth payment and how this affects the amortization ... View full answer

Get step-by-step solutions from verified subject matter experts