Question: value: 4.00 points Problem 10-14 Break-Even (LO2) Modern Artifacts can produce keepsakes that will be sold for $84 eachNon-depreciated fixed costs are $940 per year

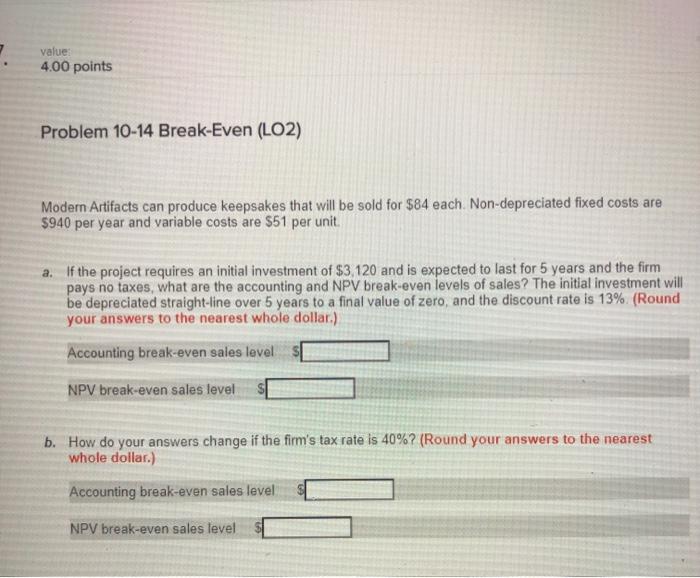

value: 4.00 points Problem 10-14 Break-Even (LO2) Modern Artifacts can produce keepsakes that will be sold for $84 eachNon-depreciated fixed costs are $940 per year and variable costs are $51 per unit a. If the project requires an initial investment of $3,120 and is expected to last for 5 years and the firm pays no taxes, what are the accounting and NPV break-even levels of sales? The initial investment will be depreciated straight-line over 5 years to a final value of zero, and the discount rate is 13% (Round your answers to the nearest whole dollar.) Accounting break-even sales level NPV break-even sales level b. How do your answers change if the firm's tax rate is 40%? (Round your answers to the nearest whole dollar.) Accounting break-even sales level si NPV break-even sales level

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts