Question: Value a 2-period futures option G using the binomial model? The option is defined by the terminal payoff as given below where F(2) is

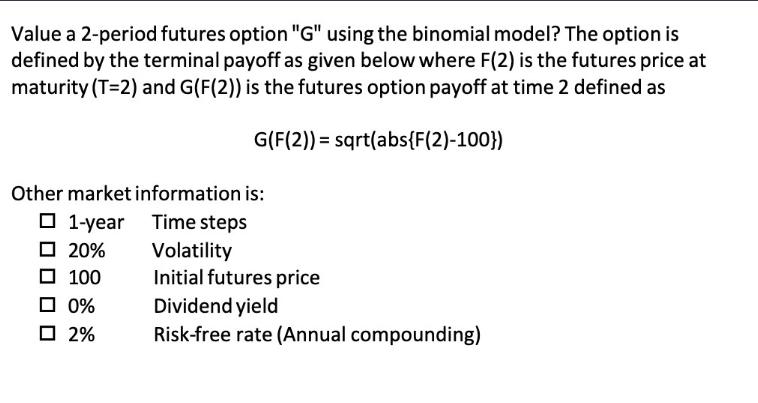

Value a 2-period futures option "G" using the binomial model? The option is defined by the terminal payoff as given below where F(2) is the futures price at maturity (T=2) and G(F(2)) is the futures option payoff at time 2 defined as G(F(2)) = sqrt(abs{F(2)-100}) Other market information is: 1-year Time steps 20% Volatility 100 Initial futures price 0% Dividend yield 2% Risk-free rate (Annual compounding)

Step by Step Solution

3.33 Rating (144 Votes )

There are 3 Steps involved in it

Calculation of the parameters for the binomial model Time to expiration T 2 years Number of time ste... View full answer

Get step-by-step solutions from verified subject matter experts