Question: Value at Risk (VaR) and Expected Shortfall (ES) aims to provide a single number that summarises the total risk of a portfolio. True False Reset

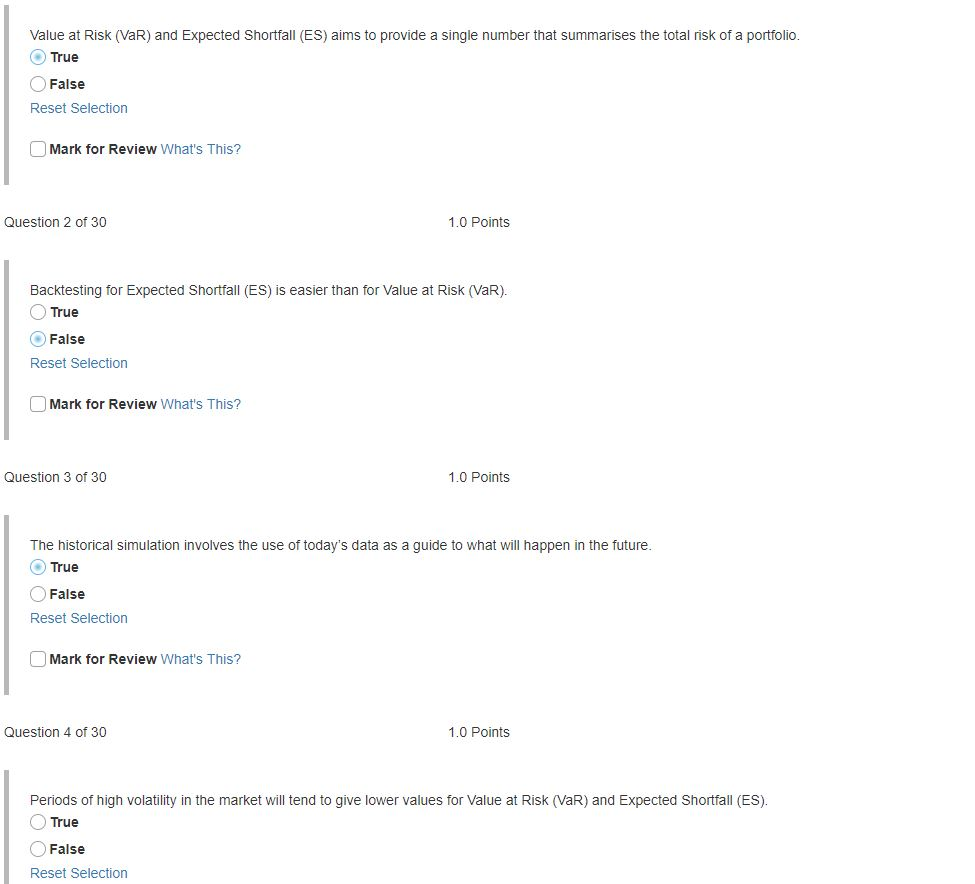

Value at Risk (VaR) and Expected Shortfall (ES) aims to provide a single number that summarises the total risk of a portfolio. True False Reset Selection Mark for Review What's This? Question 2 of 30 1.0 Points Backtesting for Expected Shortfall (ES) is easier than for Value at Risk (VaR). True False Reset Selection Mark for Review What's This? Question 3 of 30 1.0 Points The historical simulation involves the use of today's data as a guide to what will happen in the future. True False Reset Selection Mark for Review What's This? Question 4 of 30 1.0 Points Periods of high volatility in the market will tend to give lower values for Value at Risk (VaR) and Expected Shortfall (ES). True False Reset Selection

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts