Question: Value at Risk (VAR) Modeling and SWAPS - Use the following information to answers questions 6-10. Titan Bank's Balance Sheet Assets $1,100 Liabilities $1,010 Assets

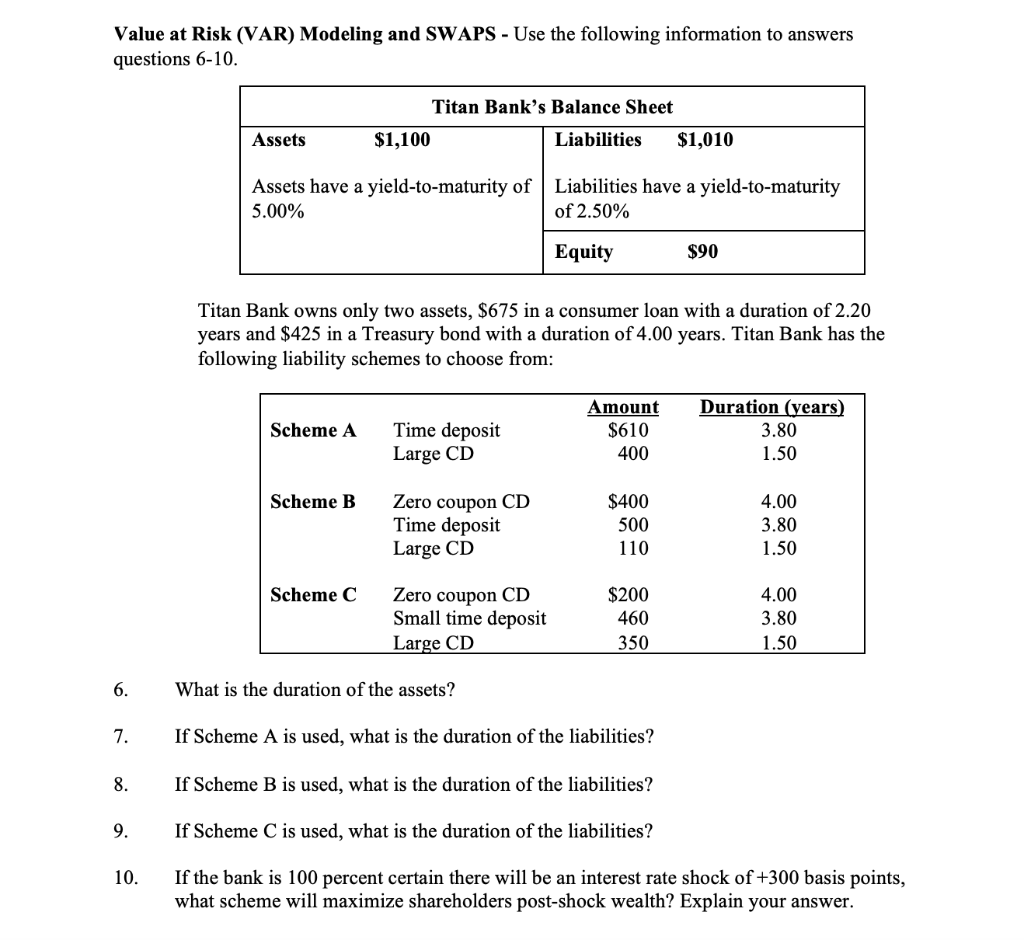

Value at Risk (VAR) Modeling and SWAPS - Use the following information to answers questions 6-10. Titan Bank's Balance Sheet Assets $1,100 Liabilities $1,010 Assets have a yield-to-maturity of 5.00% Liabilities have a yield-to-maturity of 2.50% Equity $90 Titan Bank owns only two assets, $675 in a consumer loan with a duration of 2.20 years and $425 in a Treasury bond with a duration of 4.00 years. Titan Bank has the following liability schemes to choose from: Scheme A Time deposit Amount $610 400 Duration (years) 3.80 1.50 Large CD Scheme B Zero coupon CD Time deposit Large CD $400 500 110 4.00 3.80 1.50 Scheme C Zero coupon CD Small time deposit Large CD $200 460 350 4.00 3.80 1.50 6. What is the duration of the assets? 7. If Scheme A is used, what is the duration of the liabilities? 8. If Scheme B is used, what is the duration of the liabilities? 9. If Scheme C is used, what is the duration of the liabilities? 10. If the bank is 100 percent certain there will be an interest rate shock of +300 basis points, what scheme will maximize shareholders post-shock wealth? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts