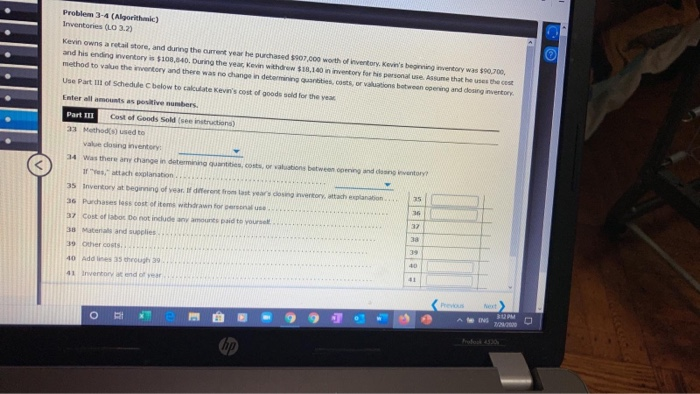

Question: value closing inventory: 34 Was there any change in determining quantities, costs, or valuations between opening and closing inventory? If Yes, attach explanation . .

| value closing inventory: | |

| 34 | Was there any change in determining quantities, costs, or valuations between opening and closing inventory? |

| If "Yes," attach explanation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

| 35 | Inventory at beginning of year. If different from last year's closing inventory, attach explanation . . . . | 35 | ||

| 36 | Purchases less cost of items withdrawn for personal use . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | 36 | ||

| 37 | Cost of labor. Do not include any amounts paid to yourself. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | 37 | ||

| 38 | Materials and supplies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | 38 | ||

| 39 | Other costs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | 39 | ||

| 40 | Add lines 35 through 39 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | 40 | ||

| 41 | Inventory at end of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . | 41 | ||

| 42 | Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4 . . . . . . . . | 42 |

Problem 3-4 (Algorithmic) Inventories (L03.2) Kevin owns a retail store, and during the current year he purchased $907.000 worth of Inventory. Kevin's beginning inventory was $90,700, and his ending inventory is $108.640. During the year, Kevin withdrew $18,140 in inventory for his personal use. Assume that he uses the cost method to value the inventory and there was no change in determining Quarties, costs, or valuations between opening and doing inventory Use Part of Schedule below to calculate Kev's cost of goods sold for the year Enter all amounts as positive bers. Part II Cost of Goods sold seeintruction) 23 Methods used to value dosing inventory 34 was there any change in determining costs, or vions between condong Ir attach explanation 35 Inventory at beginning of verifdiferent from last years doing into action 75 36 36 Purchases les cost of items withdrawn for personas 37 37 Cost of bot De not include any amount paid to yourself 38 38 Materials and suplies 39 39 Other costs 40 Add lines through 39 10 41 Inventory end of 11 O RI X INS 30PM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts