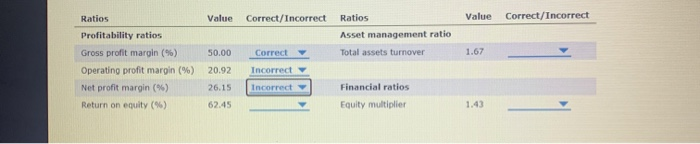

Question: Value Correct/Incorrect Value Correct/Incorrect Ratios Asset management ratio Total assets turnover 50.00 Correct 1.67 Ratios Profitability ratios Gross profit margin (%) Operating profit margin (%)

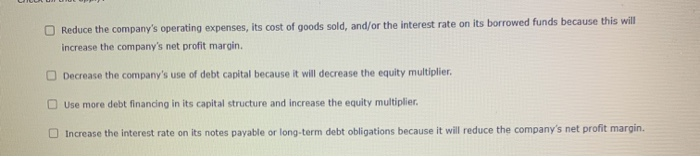

Value Correct/Incorrect Value Correct/Incorrect Ratios Asset management ratio Total assets turnover 50.00 Correct 1.67 Ratios Profitability ratios Gross profit margin (%) Operating profit margin (%) Net profit margin (9) Return on equity (%) 20.92 Incorrect 26.15 Incorrect Financial ratios Equity multiplier 62.45 1.43 Reduce the company's operating expenses, its cost of goods sold, and/or the interest rate on its borrowed funds because this will increase the company's net profit margin. Decrease the company's use of debt capital because it will decrease the equity multiplier. Use more debt financing in its capital structure and increase the equity multiplier. Increase the interest rate on its notes payable or long-term debt obligations because it will reduce the company's net profit margin. Value Correct/Incorrect Value Correct/Incorrect Ratios Asset management ratio Total assets turnover 50.00 Correct 1.67 Ratios Profitability ratios Gross profit margin (%) Operating profit margin (%) Net profit margin (9) Return on equity (%) 20.92 Incorrect 26.15 Incorrect Financial ratios Equity multiplier 62.45 1.43 Reduce the company's operating expenses, its cost of goods sold, and/or the interest rate on its borrowed funds because this will increase the company's net profit margin. Decrease the company's use of debt capital because it will decrease the equity multiplier. Use more debt financing in its capital structure and increase the equity multiplier. Increase the interest rate on its notes payable or long-term debt obligations because it will reduce the company's net profit margin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts