Question: Value creation often has been associated with the capital budgeting decision, but perhaps it is not the only avenue for adding value to the firm.

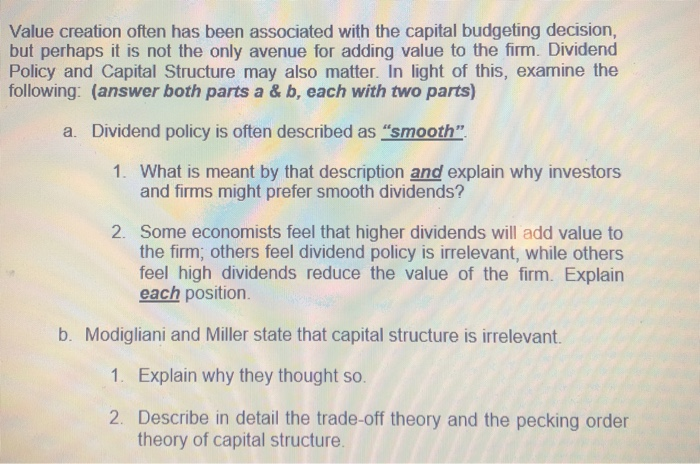

Value creation often has been associated with the capital budgeting decision, but perhaps it is not the only avenue for adding value to the firm. Dividend Policy and Capital Structure may also matter. In light of this, examine the following: (answer both parts a & b, each with two parts) a. Dividend policy is often described as "smooth" 1. What is meant by that description and explain why investors and firms might prefer smooth dividends? 2. Some economists feel that higher dividends will add value to the firm; others feel dividend policy is irrelevant, while others feel high dividends reduce the value of the firm. Explain each position. b. Modigliani and Miller state that capital structure is irrelevant. 1. Explain why they thought so. 2. Describe in detail the trade-off theory and the pecking order theory of capital structure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts