Question: value derived from exercising an option immediately is the exercise value. No rational investor would exercise an ion that is out-of-the-money, so the minimum exercise

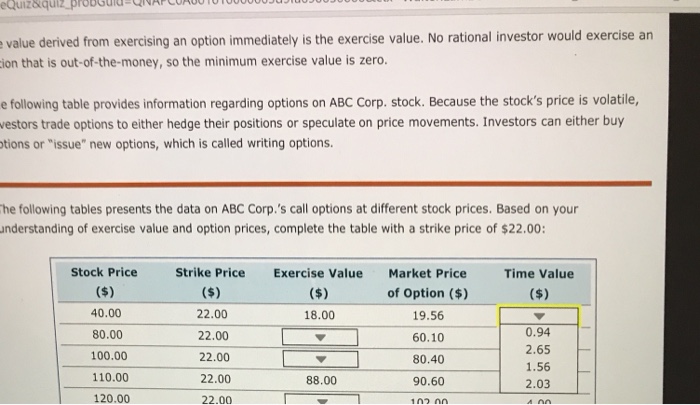

value derived from exercising an option immediately is the exercise value. No rational investor would exercise an ion that is out-of-the-money, so the minimum exercise value is zero. e following table provides information regarding options on ABC Corp. stock. Because the stock's price is volatile, estors trade options to either hedge their positions or speculate on price movements. Investors can either buy ptions or "issue" new options, which is called writing options he following tables presents the data on ABC Corp.'s call options at different stock prices. Based on your nderstanding of exercise value and option prices, complete the table with a strike price of $22.00 Stock Price Strike Price Exercise Value Market Price of Option ($) 19.56 60.10 80.40 90.60 Time Value 40.00 80.00 100.00 110.00 120.00 22.00 22.00 22.00 22.00 22.00 18.00 0.94 2.65 1.56 2.03 A 00 88.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts