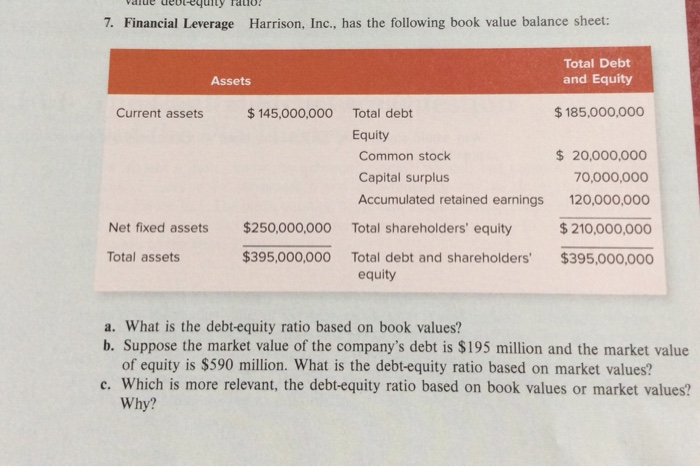

Question: value devlequily Fallo! 7. Financial Leverage Harrison, Inc., has the following book value balance sheet: Total Debt and Equity Assets Current assets $ 145,000,000 $

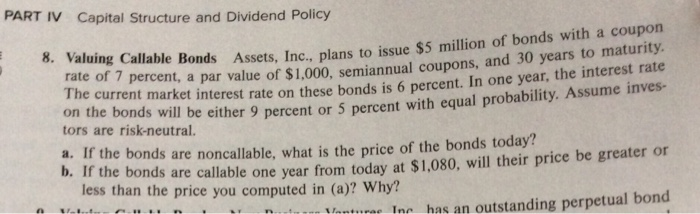

value devlequily Fallo! 7. Financial Leverage Harrison, Inc., has the following book value balance sheet: Total Debt and Equity Assets Current assets $ 145,000,000 $ 185,000,000 Total debt Equity Common stock Capital surplus Accumulated retained earnings Total shareholders' equity Total debt and shareholders equity $ 20,000,000 70,000,000 120,000,000 $ 210,000,000 $395,000,000 Net fixed assets $250,000,000 $395,000,000 Total assets a. What is the debt-equity ratio based on book values? b. Suppose the market value of the company's debt is $195 million and the market value of equity is $590 million. What is the debt-equity ratio based on market values? c. Which is more relevant, the debt-equity ratio based on book values or market values? Why? PART IV Capital Structure and Dividend Policy 8. Valuing Callable Bonds Assets, Inc., plans to Bonds Assets, Inc., plans to issue $5 million of bonds with a coupon rate of 7 percent, a par value of $1,000, sem int, a par value of $1,000, semiannual coupons, and 30 years to maturity. rent market interest rate on these bonds is 6 percent. In one year, the interest rate on the bonds will be either 9 percent or 5 percent wa tors are risk-neutral. either 9 percent or 5 percent with equal probability. Assume inves- a. If the bonds are noncallable, what is the price of the bonds today? ds are callable one year from today at $1,080, will their price be greater or less than the price you computed in (a)? Why? Yantum Ine has an outstanding perpetual bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts