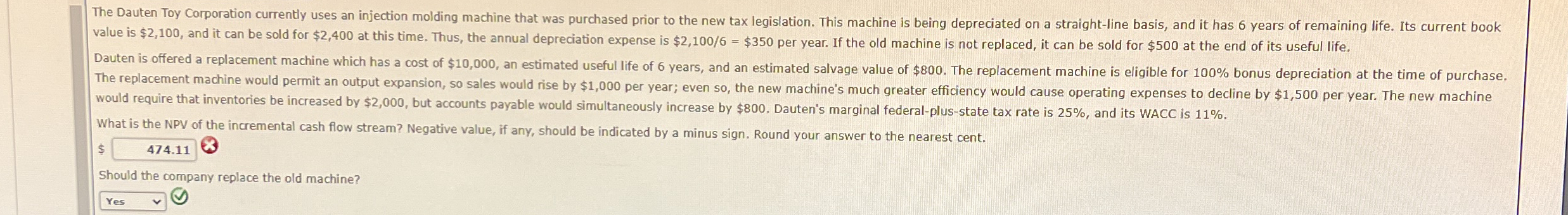

Question: value is $ 2 , 1 0 0 , and it can be sold for $ 2 , 4 0 0 at this time. Thus,

value is $ and it can be sold for $ at this time. Thus, the annual depreciation expense is $$ per year. If the old machine is not replaced, it can be sold for $ at the end of its useful life. The replacement machine would permit an output expansion, so sales would rise by $ per year; even so the new machine's much greater efficiency would cause operating expenses to decline by $ per year. The new machine would require that inventories be increased by $ but accounts payable would simultaneously increase by $ Dauten's marginal federalplusstate tax rate is and its WACC is

What is the NPV of the incremental cash flow stream? Negative value, if any, should be indicated by a minus sign. Round your answer to the nearest cent.

$

Should the company replace the old machine?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock