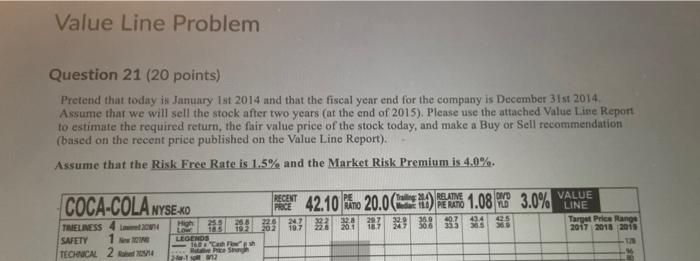

Question: Value Line Problem Question 21 (20 points) Pretend that today is January Ist 2014 and that the fiscal year end for the company is December

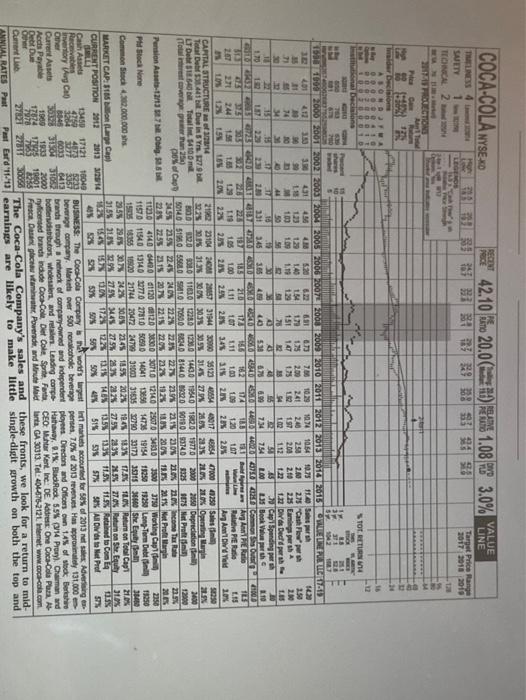

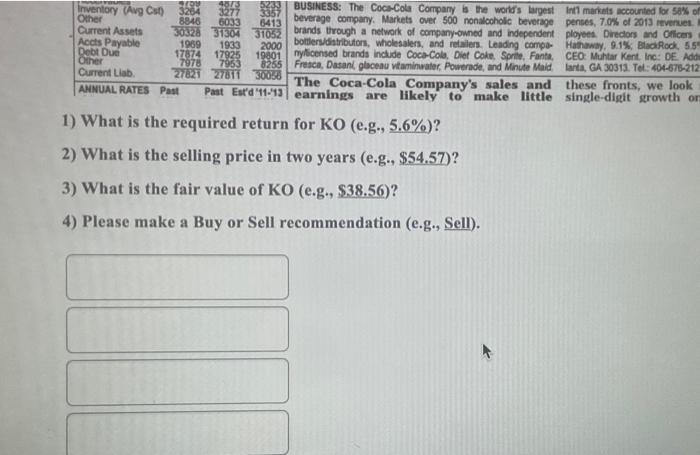

Value Line Problem Question 21 (20 points) Pretend that today is January Ist 2014 and that the fiscal year end for the company is December 31st 2014 Assume that we will sell the stock after two years at the end of 2015). Please use the attached Value Line Report to estimate the required return, the fair value price of the stock today, and make a Buy or Sell recommendation (based on the recent price published on the Value Line Report) Assume that the Risk Free Rate is 1.5% and the Market Risk Premium is 4.0%. RECENT PE COCA-COLA NYSEKO (1) a 42.10 km 20.00 RELATIVE DVD 1.08 X 9 388 483 126 3.0% VALUE 300 Targu Price Range 2017 2018 2018 TIMELINESS SAFETY TECHNICAL 2 LEGENDS TADT PS 12 COCA-COLA NYSEXO PE A 42.10 to 20.0 (1) 1.08 GIR: 9383 RATIO RELATE RERINO 3.0% VALUE TULNESS 4 SALTY TEONCAL 2 GEOS Target Price Range 2017 2018 2018 12 2 BULGTIONS AT Pola midar Decision ABOWO 16 TEE STOT RETURN 14 Decisions 59 TTT SE UT 142 10 100 100 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2011 2010 2011 LELLE NELLA LOT 412 3153 5.20 22 651 13 780 10.29 1074 10.54 10.75 11. Se 15 30 90 123 1.40 154 178 175 2.00 241 240 250 2.00 275 Cash Flowers 10 14 1.00 1.19 151 10 75 12 197 200 2.0 2.25 Casper 34 41 50 78 102 1.12 22 1.22 Direct dhe 15 15 30 25 Spenden 10 1.70 223 2 2.31 345 ses 4 40 5:38 872 6.90 7.54 7.54 LOO JS Book Value 110 GRODOTTO DISORDO Commons 33 30 7.5 210 173 1655 TA TU 13 Avg ABER TES 267 244 18 16 118 105 1.11 107 111 10 109 1.20 1.07 Www PIER L.IS 103 12 20% 225 2.05 20 2.5% 20 3416 SIS 2 20% 2.8% Any Alved 104 CAPITAL STRUCTURE 2014 21862 23104 2003 2057 319443008051234854 4801748854 47000 6250 Sales Total D341 DI S. 79 2250 3135 300%20353093145 27.5 28.03.2035 20% 20% Opening in 2. LTD 40D Total 4100 ml 2000 BOD320010116020 12300 10 TO 1920 1970 2050 Depreciation Tour 25 pos of Cape SOND-5190 5563070500 801920010974 1325 SE75 Net Profil 12000 2245 222 223 227 228 229 230 230 220come Tax Rate 20 Pension Asta Oblig. 225 2255 22152072215 225 235 1025 105 2005 13.7% 21% Not Profarin 20 T2304140 GMDOG1120GZD3300 3011214025070330 3500 3750 Working Cap P Stock None 1157 1154013140 270 27310 500 14001 196981473819154 1825 11250 Long Term Debt 11250 1925 3 9815510100217442072 20799210033180532790 2917350150 Sheby Common Stoch 2.000.000 hs 22307 2002345 185592023 1924 1923% IS Return on Total Capi 210 MARKET CAPS Large Cap 31559129278424527%22 23232732832 X 27.0% Return on Equity CURRENT POSITION 2012 2013 2014 125 13 12 11 10 13:35 115% and to com TEN 59% 50% 50% 509 4 515 55 57% 5% Alodste Net Prol 57 Cash As 134 10049 17121 Recevable BUSINESS: The Coca-Cola Company open markets accounted for 2013 refles Advertising Inventory CO 328 0033 beverage company, Marit over 500 roncholic beverage pense 70% of 2013 revenues Hus approximately 131.000 2013 Other Current Assets 30 31 32 brand trough not of company owned and independent ployees Directors and Oflom aw 145 wock Bertahan Accs Payable 1900 1930 borbutors. Wholesalers and in leading compe Hathaway 8.18 Bad Rock 5.9% (4 Proy Charmand 2000 Debit De pylensed brandendude Coca-Colt Diet Coke Sprite Fanta CEO Muhtar Kent Inc. DE Address One Coca-Cola P. A 1704 1725 7970 2888 Fmaca. Dan glace vate Powerade, and Minute Manta GA 30313. Tel: 404-575-2121. Internet www.coca-cola.com Current List 201 2781T 300% The Coca-Cola Company's sales and these fronts, we look for a return to mid- ANNUAL RATES Past Per Erd":10 earnings are likely to make little single-digit growth on both the top and AITA 100 Inventory (Avg C) 3284 3277 *** BUSINESS: The Coca-Cola Company the world's largest int markets accounted for 59% on Other 8846 6033 6413 beverage company Markets over 500 nonalcoholic beverage penses, 7.0% of 2013 revenues Current Assets 30328 31304 31052 brands through a network of company-owned and independent ployees. Directors and Officers Acts Payable 1969 1933 2000 boltersdistributors, wholesalers, and retailers. Leading compo- Hathaway, 9.1% Blad Rock 55 Debt Due 17874 17925 19801 nylicensed brands include Coca-Cola, Diet Coke, Sprite, Fanta, CEO: Muhtar Kent. Inc: DE Adde Other 7978 7953 8255 Fresca, Dasani glacenu vitaminwater Powerade and Minute Maid lanta, GA 30313. Tel.: 404-675-212 Current Liab. 278 2781130058 The Coca-Cola Company's sales and these fronts, we look ANNUAL RATES Past Past Estd 11-13 earnings are likely to make little single-digit growth or 1) What is the required return for KO (e.g., 5.6%)? 2) What is the selling price in two years (e.g., $54.57)? 3) What is the fair value of KO (e.g., $38.56)? 4) Please make a Buy or Sell recommendation (e.g., Sell). Value Line Problem Question 21 (20 points) Pretend that today is January Ist 2014 and that the fiscal year end for the company is December 31st 2014 Assume that we will sell the stock after two years at the end of 2015). Please use the attached Value Line Report to estimate the required return, the fair value price of the stock today, and make a Buy or Sell recommendation (based on the recent price published on the Value Line Report) Assume that the Risk Free Rate is 1.5% and the Market Risk Premium is 4.0%. RECENT PE COCA-COLA NYSEKO (1) a 42.10 km 20.00 RELATIVE DVD 1.08 X 9 388 483 126 3.0% VALUE 300 Targu Price Range 2017 2018 2018 TIMELINESS SAFETY TECHNICAL 2 LEGENDS TADT PS 12 COCA-COLA NYSEXO PE A 42.10 to 20.0 (1) 1.08 GIR: 9383 RATIO RELATE RERINO 3.0% VALUE TULNESS 4 SALTY TEONCAL 2 GEOS Target Price Range 2017 2018 2018 12 2 BULGTIONS AT Pola midar Decision ABOWO 16 TEE STOT RETURN 14 Decisions 59 TTT SE UT 142 10 100 100 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2011 2010 2011 LELLE NELLA LOT 412 3153 5.20 22 651 13 780 10.29 1074 10.54 10.75 11. Se 15 30 90 123 1.40 154 178 175 2.00 241 240 250 2.00 275 Cash Flowers 10 14 1.00 1.19 151 10 75 12 197 200 2.0 2.25 Casper 34 41 50 78 102 1.12 22 1.22 Direct dhe 15 15 30 25 Spenden 10 1.70 223 2 2.31 345 ses 4 40 5:38 872 6.90 7.54 7.54 LOO JS Book Value 110 GRODOTTO DISORDO Commons 33 30 7.5 210 173 1655 TA TU 13 Avg ABER TES 267 244 18 16 118 105 1.11 107 111 10 109 1.20 1.07 Www PIER L.IS 103 12 20% 225 2.05 20 2.5% 20 3416 SIS 2 20% 2.8% Any Alved 104 CAPITAL STRUCTURE 2014 21862 23104 2003 2057 319443008051234854 4801748854 47000 6250 Sales Total D341 DI S. 79 2250 3135 300%20353093145 27.5 28.03.2035 20% 20% Opening in 2. LTD 40D Total 4100 ml 2000 BOD320010116020 12300 10 TO 1920 1970 2050 Depreciation Tour 25 pos of Cape SOND-5190 5563070500 801920010974 1325 SE75 Net Profil 12000 2245 222 223 227 228 229 230 230 220come Tax Rate 20 Pension Asta Oblig. 225 2255 22152072215 225 235 1025 105 2005 13.7% 21% Not Profarin 20 T2304140 GMDOG1120GZD3300 3011214025070330 3500 3750 Working Cap P Stock None 1157 1154013140 270 27310 500 14001 196981473819154 1825 11250 Long Term Debt 11250 1925 3 9815510100217442072 20799210033180532790 2917350150 Sheby Common Stoch 2.000.000 hs 22307 2002345 185592023 1924 1923% IS Return on Total Capi 210 MARKET CAPS Large Cap 31559129278424527%22 23232732832 X 27.0% Return on Equity CURRENT POSITION 2012 2013 2014 125 13 12 11 10 13:35 115% and to com TEN 59% 50% 50% 509 4 515 55 57% 5% Alodste Net Prol 57 Cash As 134 10049 17121 Recevable BUSINESS: The Coca-Cola Company open markets accounted for 2013 refles Advertising Inventory CO 328 0033 beverage company, Marit over 500 roncholic beverage pense 70% of 2013 revenues Hus approximately 131.000 2013 Other Current Assets 30 31 32 brand trough not of company owned and independent ployees Directors and Oflom aw 145 wock Bertahan Accs Payable 1900 1930 borbutors. Wholesalers and in leading compe Hathaway 8.18 Bad Rock 5.9% (4 Proy Charmand 2000 Debit De pylensed brandendude Coca-Colt Diet Coke Sprite Fanta CEO Muhtar Kent Inc. DE Address One Coca-Cola P. A 1704 1725 7970 2888 Fmaca. Dan glace vate Powerade, and Minute Manta GA 30313. Tel: 404-575-2121. Internet www.coca-cola.com Current List 201 2781T 300% The Coca-Cola Company's sales and these fronts, we look for a return to mid- ANNUAL RATES Past Per Erd":10 earnings are likely to make little single-digit growth on both the top and AITA 100 Inventory (Avg C) 3284 3277 *** BUSINESS: The Coca-Cola Company the world's largest int markets accounted for 59% on Other 8846 6033 6413 beverage company Markets over 500 nonalcoholic beverage penses, 7.0% of 2013 revenues Current Assets 30328 31304 31052 brands through a network of company-owned and independent ployees. Directors and Officers Acts Payable 1969 1933 2000 boltersdistributors, wholesalers, and retailers. Leading compo- Hathaway, 9.1% Blad Rock 55 Debt Due 17874 17925 19801 nylicensed brands include Coca-Cola, Diet Coke, Sprite, Fanta, CEO: Muhtar Kent. Inc: DE Adde Other 7978 7953 8255 Fresca, Dasani glacenu vitaminwater Powerade and Minute Maid lanta, GA 30313. Tel.: 404-675-212 Current Liab. 278 2781130058 The Coca-Cola Company's sales and these fronts, we look ANNUAL RATES Past Past Estd 11-13 earnings are likely to make little single-digit growth or 1) What is the required return for KO (e.g., 5.6%)? 2) What is the selling price in two years (e.g., $54.57)? 3) What is the fair value of KO (e.g., $38.56)? 4) Please make a Buy or Sell recommendation (e.g., Sell)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts