Question: value will be $ 6 , 0 0 0 . The equipment operated for 6 7 5 hours the first year, 2 , 0 2

value will be $ The equipment operated for hours the first year, hours the second year, hours the third year, and hours the fourth year.

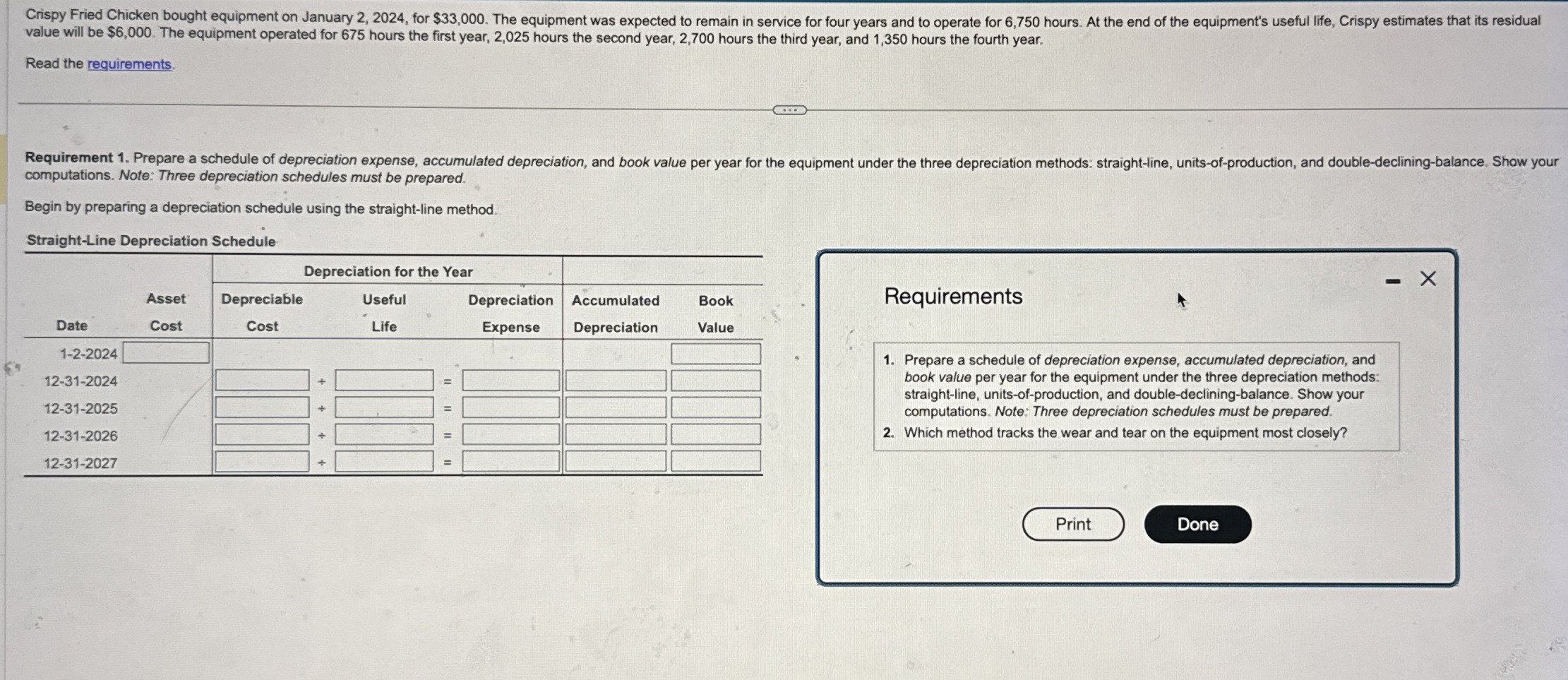

Read the requirements. computations. Note: Three depreciation schedules must be prepared.

Begin by preparing a depreciation schedule using the straightline method.

StraightLine Depreciation Schedule

tableDatetableAssetCostDepreciation for the Year,tableAccumulatedDepreciationtableBookValuetableDepreciableCosttableUsefulLifetableDepreciationExpense

Requirements

Prepare a schedule of depreciation expense, accumulated depreciation, and book value per year for the equipment under the three depreciation methods: straightline, unitsofproduction, and doubledecliningbalance. Show your computations. Note: Three depreciation schedules must be prepared.

Which method tracks the wear and tear on the equipment most closely?

Print

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock