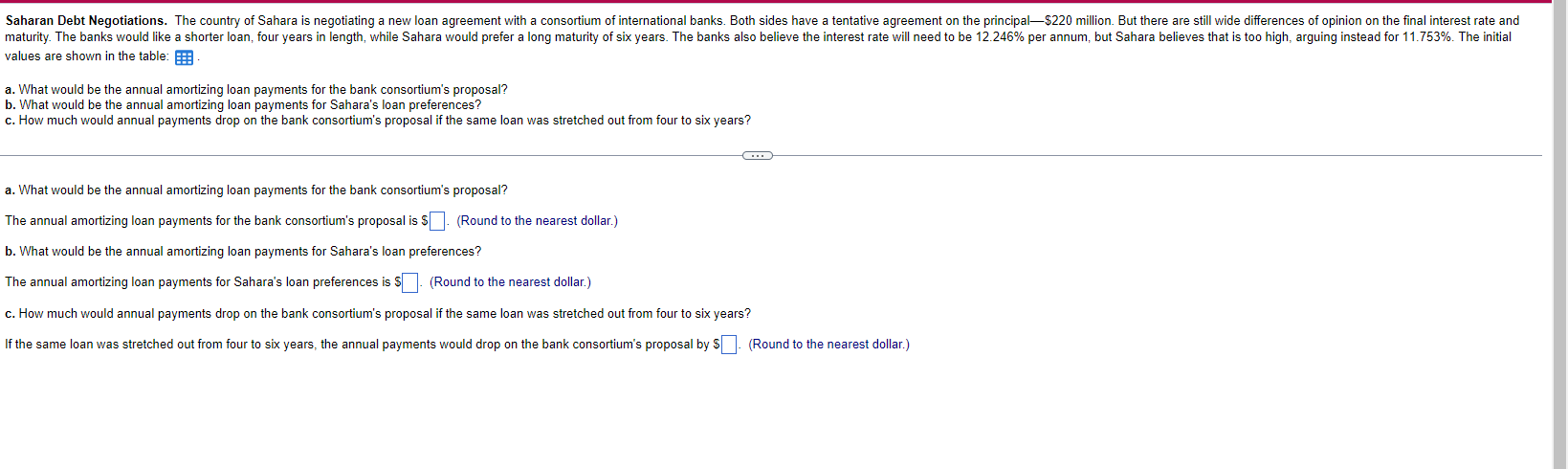

Question: values are shown in the table: a. What would be the annual amortizing loan payments for the bank consortium's proposal? b. What would be the

values are shown in the table: a. What would be the annual amortizing loan payments for the bank consortium's proposal? b. What would be the annual amortizing loan payments for Sahara's loan preferences? c. How much would annual payments drop on the bank consortium's proposal if the same loan was stretched out from four to six years? a. What would be the annual amortizing loan payments for the bank consortium's proposal? The annual amortizing loan payments for the bank consortium's proposal is \& (Round to the nearest dollar.) b. What would be the annual amortizing loan payments for Sahara's loan preferences? The annual amortizing loan payments for Sahara's loan preferences is $ (Round to the nearest dollar.) c. How much would annual payments drop on the bank consortium's proposal if the same loan was stretched out from four to six years? If the same loan was stretched out from four to six years, the annual payments would drop on the bank consortium's proposal by (Round to the nearest dollar.) values are shown in the table: a. What would be the annual amortizing loan payments for the bank consortium's proposal? b. What would be the annual amortizing loan payments for Sahara's loan preferences? c. How much would annual payments drop on the bank consortium's proposal if the same loan was stretched out from four to six years? a. What would be the annual amortizing loan payments for the bank consortium's proposal? The annual amortizing loan payments for the bank consortium's proposal is \& (Round to the nearest dollar.) b. What would be the annual amortizing loan payments for Sahara's loan preferences? The annual amortizing loan payments for Sahara's loan preferences is $ (Round to the nearest dollar.) c. How much would annual payments drop on the bank consortium's proposal if the same loan was stretched out from four to six years? If the same loan was stretched out from four to six years, the annual payments would drop on the bank consortium's proposal by (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts