Question: Valuing a bond: Below are the payments expected from a 4-year 5% bond. The first coupon payment is due one year from today. The bond

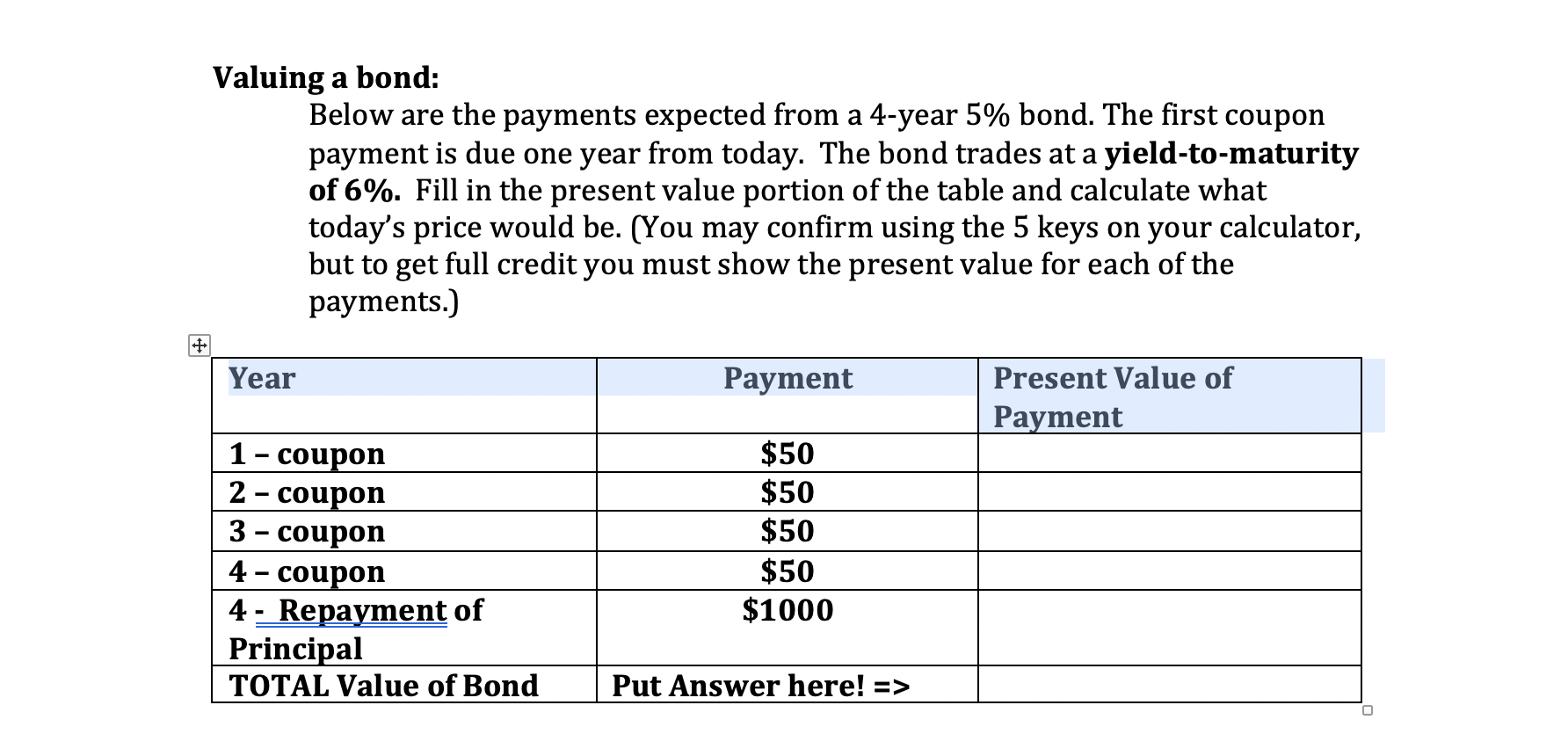

Valuing a bond: Below are the payments expected from a 4-year 5% bond. The first coupon payment is due one year from today. The bond trades at a yield-to-maturity of 6%. Fill in the present value portion of the table and calculate what today's price would be. (You may confirm using the 5 keys on your calculator, but to get full credit you must show the present value for each of the payments.) Year Payment Present Value of Payment 1 - coupon 2 - coupon 3 - coupon 4 - coupon 4 - Repayment of Principal TOTAL Value of Bond $50 $50 $50 $50 $1000 Put Answer here! =>

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts