Question: Valuing a Firm with Two Different Growth Rates Problem: Small Fry, Inc., has just invented a potato chip that looks and tastes like a french

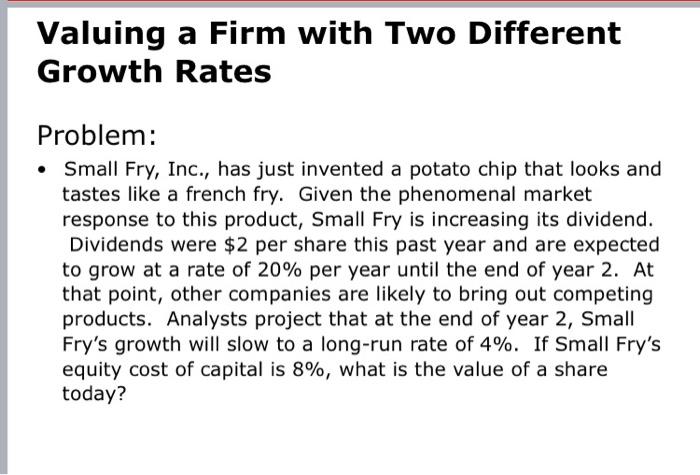

Valuing a Firm with Two Different Growth Rates Problem: Small Fry, Inc., has just invented a potato chip that looks and tastes like a french fry. Given the phenomenal market response to this product, Small Fry is increasing its dividend. Dividends were $2 per share this past year and are expected to grow at a rate of 20% per year until the end of year 2. At that point, other companies are likely to bring out competing products. Analysts project that at the end of year 2, Small Fry's growth will slow to a long-run rate of 4%. If Small Fry's equity cost of capital is 8%, what is the value of a share today

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock