Question: Valuing Bonds Before you get started on Assignment 2. you need to understand how a bond works. Your textbook discusses bond terminology and types of

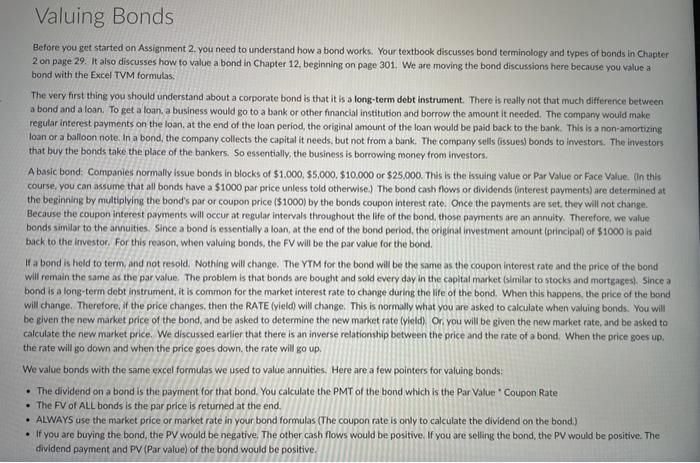

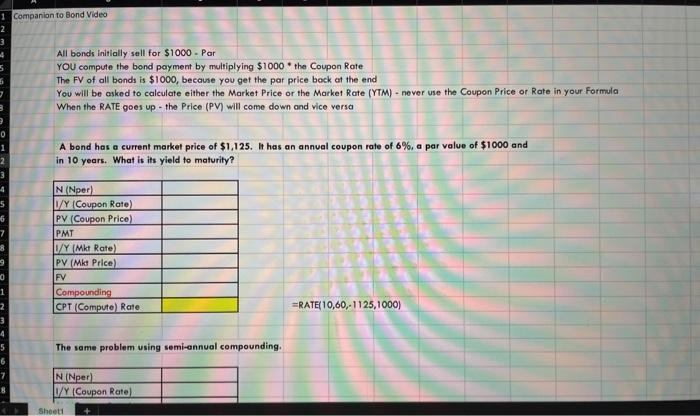

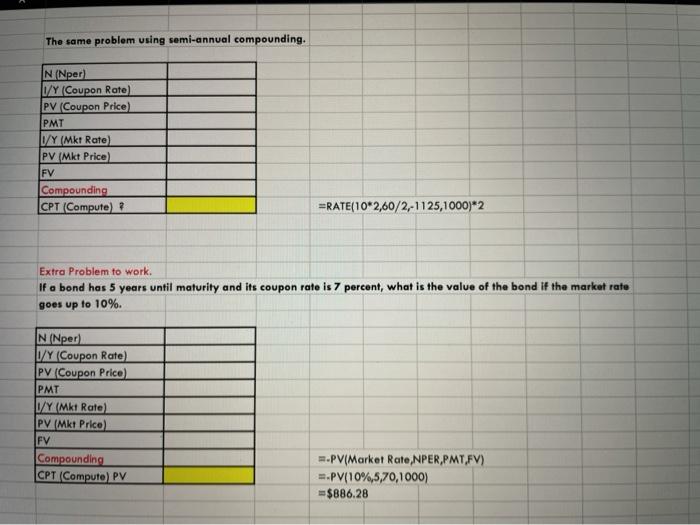

Valuing Bonds Before you get started on Assignment 2. you need to understand how a bond works. Your textbook discusses bond terminology and types of bonds in Chapter 2 on page 29. It also discusses how to value a bond in Chapter 12, beginning on page 301. We are moving the bond discussions here because you value a bond with the Excel TVM formulas. The very first thing you should understand about a corporate bond is that it is a long-term debt instrument. There is really not that much difference between a bond and a loan. To get a loan. a business would go to a bank or other financial institution and borrow the amount it needed. The company would make regular interest payments on the loan, at the end of the loan period, the original amount of the loan would be paid back to the bank. This is a non-amortizing loan or a balloon note. In a bond the company collects the capital it needs, but not from a bank. The company sells (issues) bonds to investors. The investors that buy the bonds take the place of the bankers. So essentially, the business is borrowing money from investors. A basic bond: Companies normally Issue bonds in blocks of $1,000 $5,000, $10.000 or $25,000. This is the issuing value or Par Value or Face Value. In this course, you can assume that all bonds have a $1000 par price unless told otherwise) The bond cash flows or dividends interest payments) are determined at the beginning by multiplying the bond's par or coupon price (51000) by the bonds coupon interest rate. Once the payments are set, they will not change. Because the coupon interest payments will occur at regular intervals throughout the life of the bond, those payments are an annuity. Therefore, we value bonds similar to the annuities. Since a bond is essentially a loan, at the end of the bond period, the original investment amount (principal) of $1000 is paid back to the investor. For this reason, when valuing bonds, the FV will be the par value for the bond. If a bond is held to term, and not resold. Nothing will change. The YTM for the bond will be the same as the coupon interest rate and the price of the bond will remain the same as the par value. The problem is that bonds are bought and sold every day in the capital market similar to stocks and mortgages). Since a bond is a long-term debt instrument, it is common for the market interest rate to change during the life of the bond, When this happens, the price of the bond will change. Therefore if the price changes, then the RATE (yield) will change. This is normally what you are asked to calculate when valuing bonds. You will be piven the new market price of the bond, and be asked to determine the new market rate yield) or you will be given the new market rate, and be asked to calculate the new market price. We discussed earlier that there is an inverse relationship between the price and the rate of a bond. When the price goes up, the rate will go down and when the price goes down, the rate will go up. We value bonds with the same excel formulas we used to value annuities. Here are a few pointers for valuing bonds: The dividend on a bond is the payment for that bond. You calculate the PMT of the bond which is the Par Value Coupon Rate The FV of ALL bonds is the par price is returned at the end. ALWAYS use the market price or market rate in your bond formulas (The coupon rate is only to calculate the dividend on the bond.) If you are buying the bond, the PV would be negative. The other cash flows would be positive. If you are selling the bond, the PV would be positive. The dividend payment and PV (Par value) of the bond would be positive. 1 Companion to Bond Video 2 3 All bond initially sell for $1000. Par YOU compute the bond payment by multiplying $1000 the Coupon Rate The FV of all bonds is $1000, because you get the par price back at the end You will be asked to calculate either the Market Price or the Market Rate (YTM) - never use the Coupon Price or Rate in your Formula When the RATE goes up - the Price (PV) will come down and vice versa 0 A bond has a current market price of $1,125. It has an annual coupon rate of 6%, a par value of $1000 and in 10 years. What is its yield to maturity? 3 4 5 6 7 NNper /Y (Coupon Rate) PV (Coupon Price PMT D/Y (Mkt Rate) PV (Mket Price) FV Compounding CPT (Compute) Rate 9 ERATE 10,60,-1125,1000) 1 2 3 4 5 6 7 8 The same problem using semi-annual compounding. N (Noer) V/Y ICoupon Rate) Sheet1 The same problem using semi-annual compounding. N (Nper) D/Y/Coupon Rate PV Coupon Price PMT D/Y Mkt Rato PV (Mkt Price) FV Compounding CPT (Compute) ? =RATE(10*2,60/2,-1125,1000)*2 Extra Problem to work. If a bond has 5 years until maturity and its coupon rate is 7 percent, what is the value of the bond If the market rate goes up to 10%. N (Nper D/Y (Coupon Rate) PV (Coupon Price) PMT D/Y (Mkt Rate) PV (Mkt Price IFV Compounding CPT (Compute) PV PV/Market Rate,NPER,PMT,FV) =.PV(10%,5,70,1000) =$886.28

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts